Data Insights for Private Equity

Using portfolio company performance data to make decisions and achieve the investment thesis sounds simple. But most private equity firms know there are plenty of bumps in the road – talent to mine data, software costs, extended timelines, and cumbersome legacy technology, to name a few.

In an assessment of 40 acquisition targets, we found that perceived analytics capabilities exceeded actual capabilities in most cases. Building those capabilities takes investment and, more significantly, a lot of time.

We have a better solution: a data insight offering built especially for private equity, powered by our proprietary asset, Intellio® DataOps. We provide the tools to automate time-consuming tasks of ingesting, consolidating, and distributing data from multiple systems. And we combine that with analytics expertise and a unique understanding of the reporting needs of private equity, based on experience with more than a dozen industry leaders.

That means action-ready insight, delivered faster.

Results You Can Expect

- Generate insight 2 to 3 times faster and at a 30% to 60% lower cost than a custom analytics solution

- Improve reliability and quality of data analytics

- Integrate and report on new data or new portfolio companies faster

- Accelerate value creation

What We Offer

Envision your data insights program

What does your ideal performance insight look like? Every firm is different. That’s why we work with you up front to understand your reporting and analysis needs and your portfolio and then identify the key performance indicators that matter most to your firm and investors. That way, we can tailor our offering to suit your vision and the value you want to achieve.

Build and pilot a solution

How will it work? We will work together to explore that, with a pilot or proof-of-concept solution in one portfolio company or other designated area. This way, your firm can see the art of the possible. It also gives us a chance to assess and address data quality and help refine your KPI selection. We will also help you prioritize additional reporting needs you might need, provide advice on specific analytics use cases, and enhance capabilities over time.

Establish effective governance

How should you manage it? In any data analytics initiative, governance is critical. We will help you establish processes and controls that are appropriate for your organization and portfolio companies. We will also map a practical plan and, if relevant, establish a program management office equipped with proven management tools and experienced resources.

Operationalize new data insight across your portfolio

We help you quickly integrate portfolio companies using standardized data models that are industry-specific. And then we generate meaningful insights and put the information into the hands of decision makers quickly to enable change.

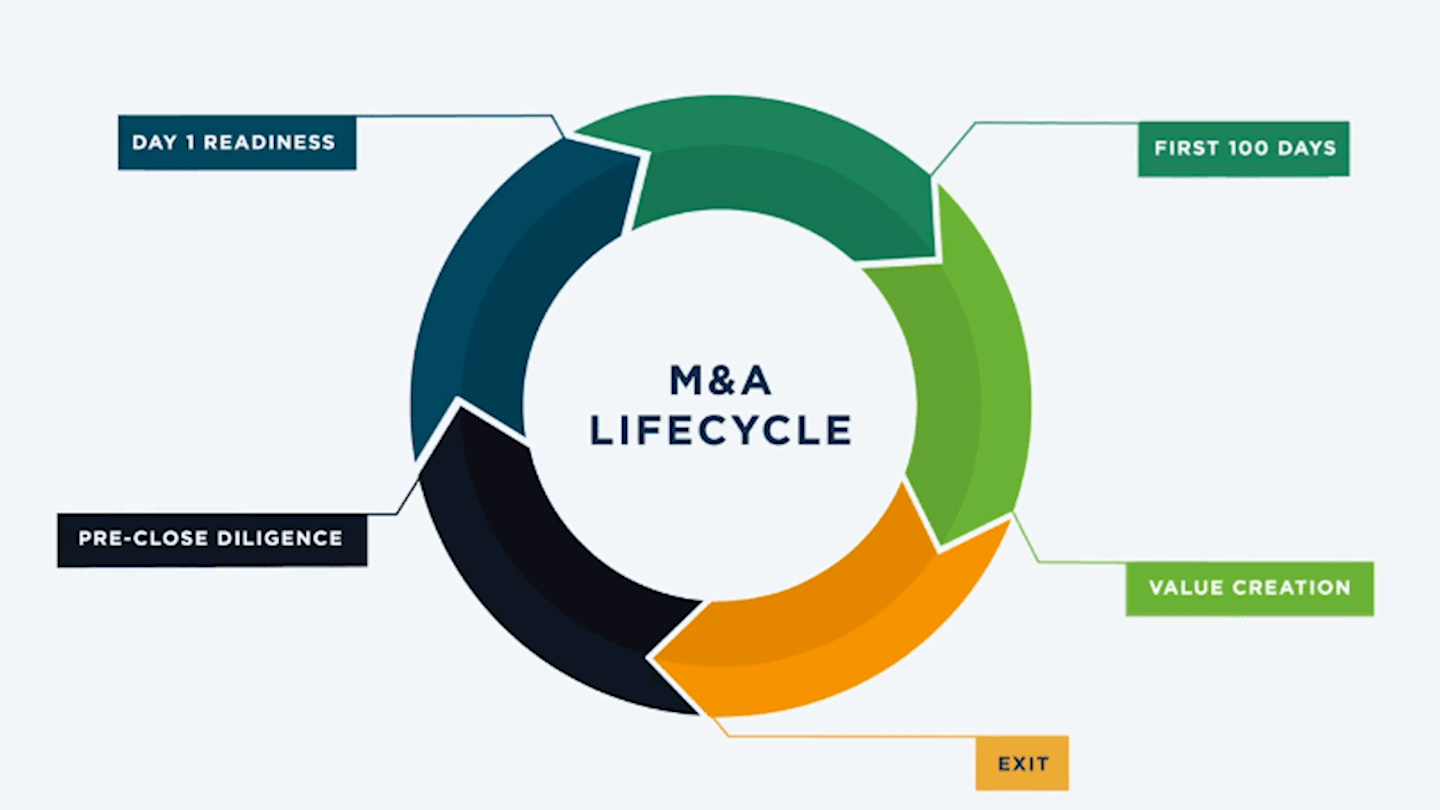

Using Intellio® to create value across the M&A lifecycle

Interested in easier, better M&A? Private equity firms that buy, build, and sell platforms can use West Monroe’s Intellio® suite to drive more value.