Archive | InBrief

Brand transition: One of the least appreciated keys to M&A success

Brand transition: One of the least appreciated keys to M&A success

In an age when brands can carry a significant premium, failing to account for how they are managed as part of an M&A transaction can quickly erode value.

Brand equity—the commercial value derived from customer perception of a brand name—can account for a significant percentage of total deal value in an M&A transaction. Going back to the early 2000s—well before the current deal cycle—researchers found that brand portfolio value can account for 50% or more of total firm value in a transaction. Going forward, the value assigned to brands will likely only increase as customers have more choices (due to globalization, low-cost manufacturing, etc.) and switching costs decrease.

Put simply, the best brands are sticky. They command attention, foster loyalty and provide a platform for growth. From technology to retail to business and financial services, premium brands command premium prices. Consequently, having a clear strategy and plan for how brands—especially high-profile and consumer-oriented ones—are transitioned in an M&A transaction is critical to capturing full value from a deal.

Conversely, failing to account for where and how acquired brands appear, how they will fit into an overall brand architecture post-transaction, and how to “walk customers across” to the new entity can cause confusion in the market, customer churn, legal risk, and value erosion. Sadly, these negative outcomes are all too common in part because brand value can be difficult to quantify. It can, therefore, be difficult to justify spending time and energy to formulate a to-be brand strategy and execute the transition. Instead, buyers tend to focus on more “tangible” assets during integration (headcount, IT, physical locations, etc.).

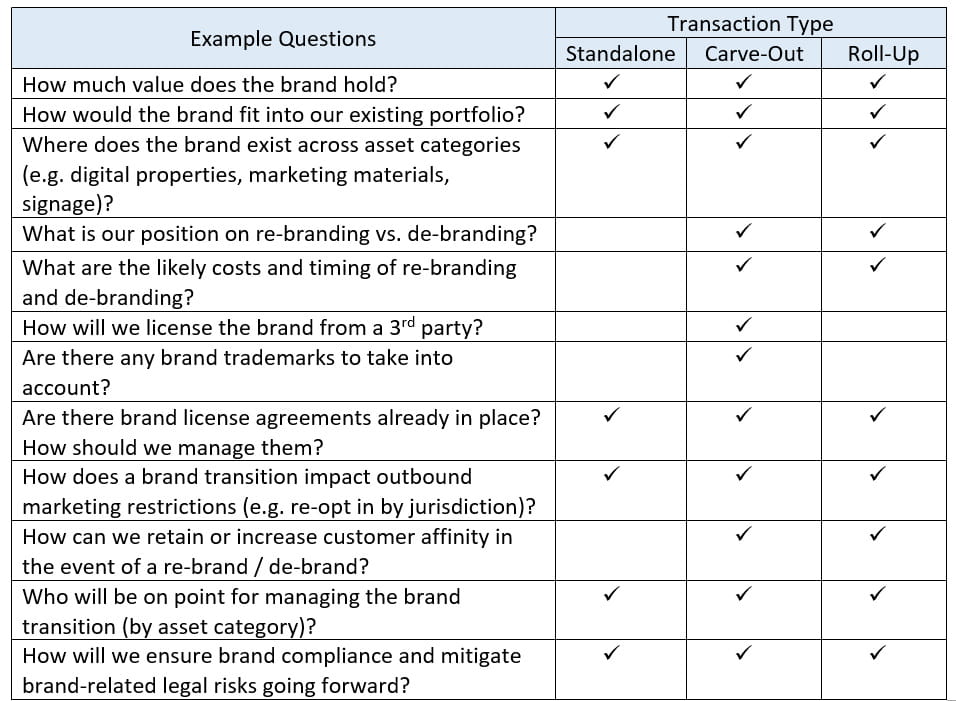

Arguably nowhere are these risks more acute than in carve-outs and roll-ups; however, even in standalone transactions, successfully transitioning brands—and capturing the value associated with those brands—requires addressing several key questions:These questions should be critical considerations regardless of deal size. Our team has assisted companies ranging from Global 100 multinationals to mid-market players plan for and manage successful brand transitions as part of M&A transactions. In each of those cases, successful transition has directly impacted customer retention and enabled our clients to extract as much value as possible from the acquired brands.