May 1, 2015 | InBrief

The cloud software shift: Rethinking professional services economics

As the software industry continues its move to the cloud, companies must understand their attach rate, and measure and act on their PSVE score

The cloud software shift: Rethinking professional services economics

Within the technology sector, software-related Professional Services is a $700 billion market, which includes everything from systems integration to software deployment to network consulting. Currently, the Professional Services (PS) market is undergoing a rapid spending and value shift driven in large part by the industry’s continued migration to the Cloud and subscription-based models. While the overall PS market is increasing, it is doing so at a slowing growth rate of 3 percent. At the same time, $40 billion of annual new Professional Services is being created to support the software market’s migration to Cloud-based solutions. This spending and value shift has major implications for enterprise software companies, which traditionally earn 15 to 20 percent or more of total revenue from Professional Services. It also has significant implications for third-party PS providers, which typically account for two-thirds of the PS market.

Understanding the Cloud Shift and the Opportunities It Presents

It is no surprise that the trends impacting software today are also affecting the Professional Services that go with that software. Cloud software allows customers to leverage best-in-class functions and features, and it is easier to use and access. Customers also expect faster, easier, and less expensive implementations as well as a steady stream of high value, low cost (or no cost) upgrades. At the same time, the market shift to the Cloud has triggered increased demand for Professional Services. These new market growth opportunities are on the table for those software companies and third-party PS providers that are able to provide Cloud consulting and integration services. However, to effectively capitalize on this market shift, providers must understand why the overall rate of PS growth is declining and proactively plan and act to address these new market dynamics.

While the Cloud shift has introduced software with faster, easier, and less expensive implementations and upgrades, it has also triggered increased demand for Professional Services relating to the Cloud.

Rethinking Professional Services Economics

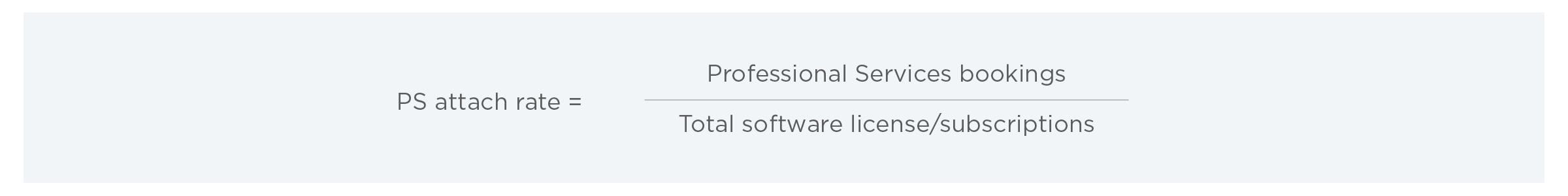

Professional Services are commonly measured in terms of a “PS attach rate”—the ratio of PS bookings to the total software licensing/subscription bookings for a given licensing/subscription event:

For example, if $125,000 of Professional Services are booked to configure and install $50,000 of contracted software licenses or subscriptions, then the PS attach rate would be $125,000 / $50,000 for a 2.5x PS attach rate.

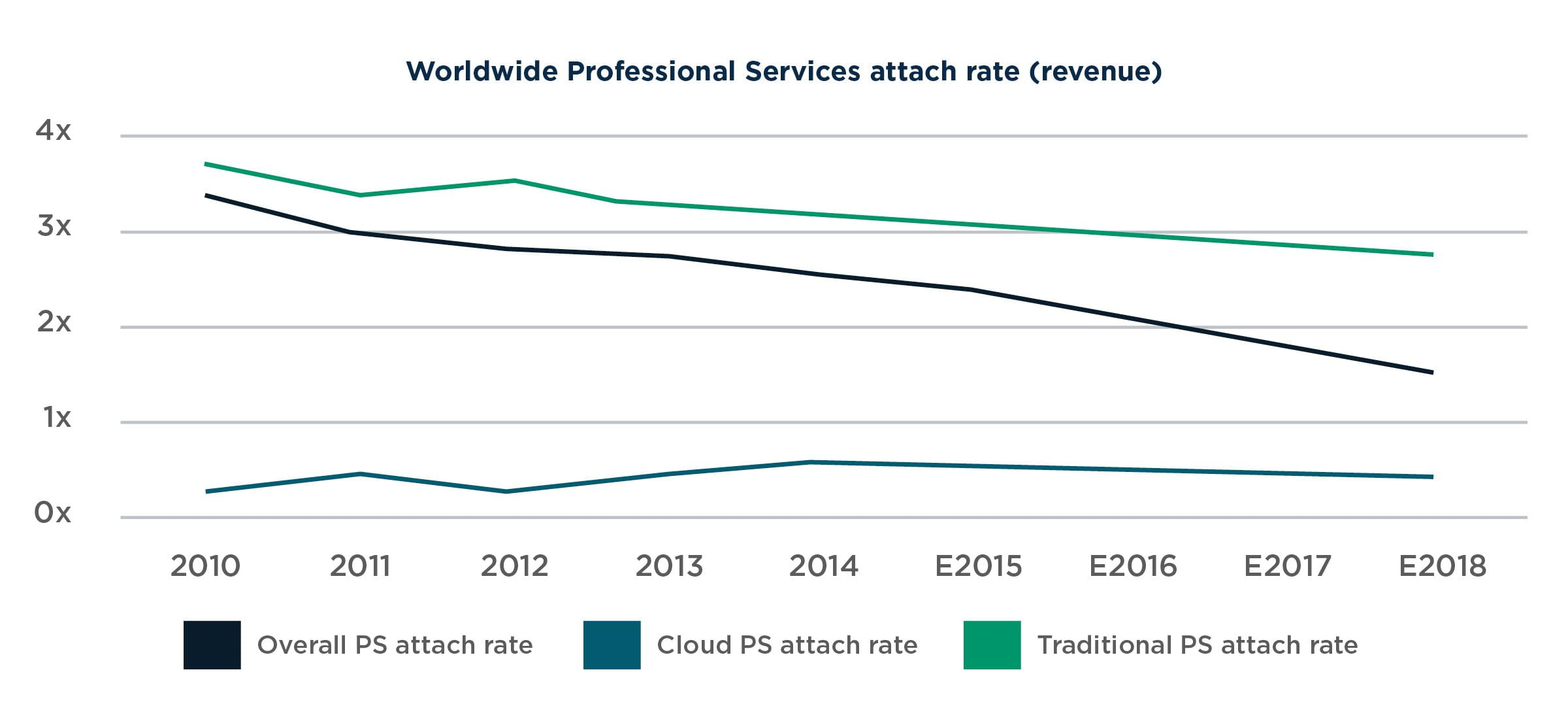

The overall PS attach rate has progressively been decreasing in recent years and this trend will continue. From West Monroe’s analysis of the global software industry, the overall PS attach rate, including both software companies and third-party service providers, fell from 3.2x in 2010 to 2.6x in 2014. By 2018, it is estimated to fall to 2.1x.

Two major themes are driving this continual drop in PS attach rate:

There is growing preference for Cloud- and SaaS-based solutions that, on average, have a PS attach rate around 0.5x to 1.0X (versus the 2.9x PS attach rate commonly seen with traditional licensed products). In 2010, these solutions accounted for less than 10 percent of worldwide commercial software licenses and subscriptions. By 2014, their share of the market had grown to 19 percent, with a go-forward growth rate of 30% projected for 2014 to 2018.

Traditional on-premise software is becoming easier to implement, configure, install, etc., resulting in a slowing growth rate of just over 2 percent for this segment of the PS market.

While the 0.6x decrease in overall PS attach rate from 2010 to 2014 (3.2x to 2.6x) may not seem dramatic at first glance, it needs to be viewed in the context of worldwide software sales. For 2015, worldwide commercial software new licenses and subscriptions are estimated to land around $275 billion; a 0.6x PS attach decline applied to $275 billion results in more than $150 billion in PS revenue that is no longer available to the marketplace. That’s not to say that the PS market is shrinking—it is growing in tandem with new licenses and subscription sales, albeit at a slower rate.

Our view is that the decline in overall PS attach rate may not be as severe as expected if the Cloud-based PS market grows more rapidly than is currently projected. As software providers broaden their offerings and develop ecosystems, there is room for value-added services to grow as well. One example of this is the ecosystem that Salesforce has built, which includes a vast number of third-party add-on services that are available post-implementation. Analyst estimates have put the size of Salesforce’s third-party services ecosystem at around $6 billion annually, which nets a PS attach rate approaching that of traditional software products.

Planning and Acting on the Professional Services Shift

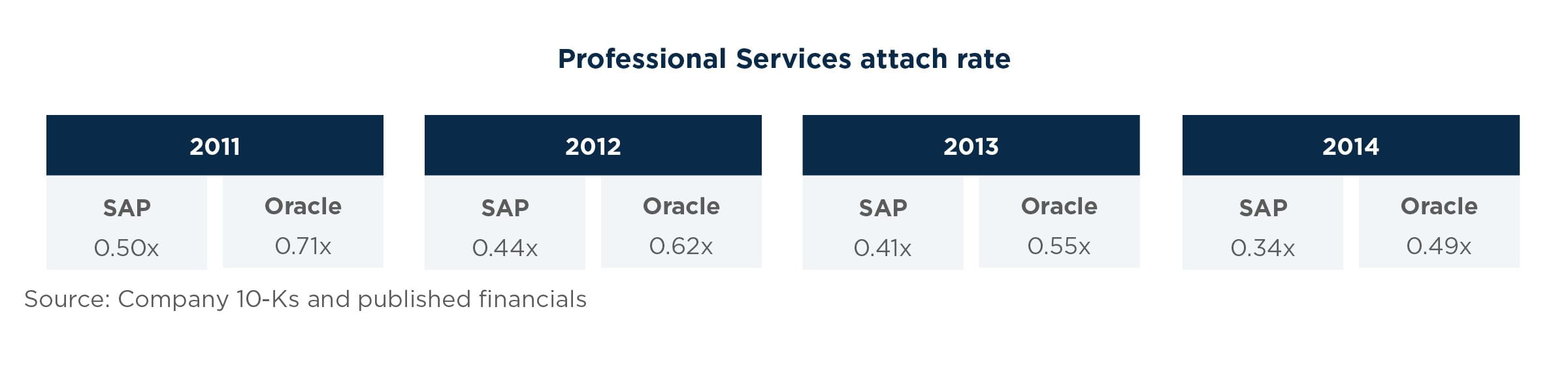

Software companies with a PS arm should look to reset expectations around traditional PS revenue and margins. With Professional Services typically accounting for 15 to 20 percent of total enterprise revenue, a declining PS attach rate can have significant implications to the organization’s overall performance. We’re seeing this decline across the broad spectrum of software companies regardless of size, industry, or age. This is clearly evident in the software bellwethers, who have experienced a decline in PS attach rate over recent years, including SAP and Oracle:

Beyond the numbers, a reduction in Professional Services may result in less customer interaction at a critical point in the relationship’s formation. The PS organization is central to managing and driving the customer experience; a positive first interaction or PS experience can lay the foundation for a long-term, mutually beneficial relationship. Furthermore, quality PS onboarding and implementation services present an opportunity to get a thorough understanding of the customer’s business—surfacing ways to provide additional value-added software and services.

Gaining Deeper Insight through PSVE

For a software company, understanding its PS attach rate is just the first step in addressing the implications that the shift to the Cloud will have on Professional Services and the organization as a whole. To gain a more in-depth understanding, a software company also needs to determine what West Monroe calls the “Professional Services Value Equation” (or PSVE) score. PSVE measures more than the standard PS attach rate; it also factors in Professional Services’ impact on driving post-sales upsell/add-on software and services (add-on attach) and on increased customer retention and overall customer satisfaction/referenceability (Customer Success attach):

PSVE = Standard PS Attach Rate + Add-on Attach + Customer Success Attach

To illustrate by example, assume a software provider has $300 million in annual PS implementation and onboarding revenue attached to $200 million in combined on-premise and subscription revenue, resulting in a 1.5x standard PS attach rate. Now assume the following:

- Standard PS Attach: Implementation services have declined from $300 million to $250 million, resulting in a corresponding reduction in a standard PS attach rate of 1.5x to 1.25x.

- Software Revenue Contribution: Of the $200 million in combined revenue, $100 million is on-premise revenue and $100 million is subscription revenue.

- Add-on Attach: $40 million in software and services were sold as an add-on after implementation, equating to an add-on attach rate of 0.2x ($40 million / $200 million).

- Customer Success Attach: Improved Customer Success services have resulted in a 6 percent reduction in the annual customer churn rate, contributing $6 million in new revenue (6 percent x $100 million of subscription revenue). This translates to a Customer Success attach rate of 0.03x ($6 million / $200 million total on-premise and subscription revenue).

Given the above assumptions, the PSVE score is calculated as follows:

Standard PS Attach Rate + Add-on Attach + Customer Success Attach = PSVE Score

1.25x + 0.2x + 0.03x = 1.48x

If the software company looks solely at the standard PS attach rate at a point in time (initial implementation/onboarding), the company misses the value (and revenue impact) that Professional Services can/should provide over the customer lifecycle. However, if the company measures and acts upon the more comprehensive view of Professional Services’ impact on the company’s customers and revenue as measured by the PSVE score, then the company is leveraging Professional Services to create value – for the customer and the software company. In short, with the industry shifting to SaaS and Cloud-based solutions, the PSVE allows software companies to measure the complete enterprise value that Professional Services provides.

Capitalizing on the Professional Services Shift

The software industry’s increasing migration to the Cloud will continue to impact and challenge PS organizations, whether they are servicing subscription-based products, licensed products, or a combination of the two. Software companies that have an in-depth understanding of their current PS attach rate, and measure and act on their PSVE score will create the most value for their customers and their enterprises from this market shift.