Aug. 13, 2014 | InBrief

How to beat the S&P 500…lead at customer experience

How to beat the S&P 500…lead at customer experience

In the movie Wall Street, corporate raider Gordon Gekko (Michael Douglas) interrogates young, upstart stock broker Bud Fox (Charlie Sheen), “Do you know why fund managers can’t beat the S&P 500? "Cause they’re sheep, and sheep get slaughtered!” However, there appears to be an easy, fail-safe way to consistently outperform the S&P 500 Index without getting slaughtered…invest in a portfolio of firms that lead their industry in customer experience. We found that these championing firms tend to have growth in stock price and market capitalization beyond market averages.

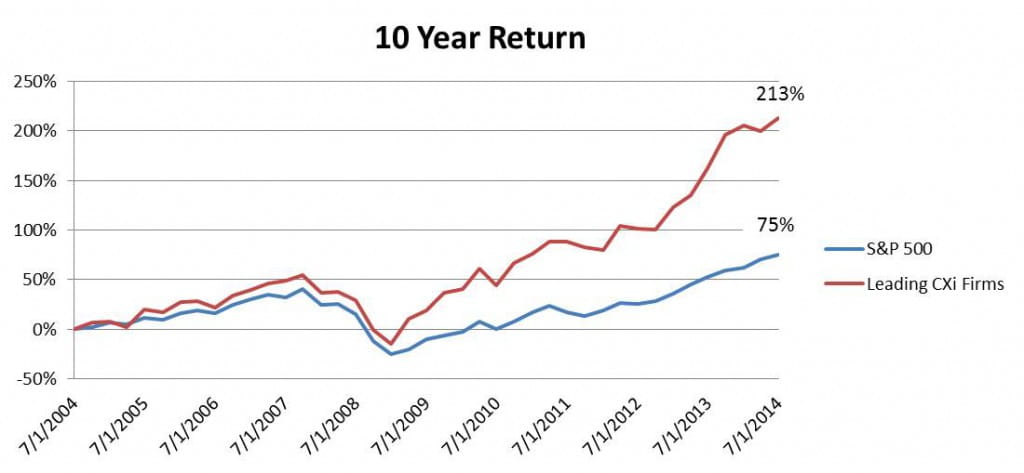

Companies know today’s consumer has an increasing amount of power and influence – providing an effortless, multi-channel experience can turn an individual from a one-and-done customer into a lifetime customer. That being true, companies still have a hard time connecting customer experience to bottom line profits. What is the ROI of a great customer experience? Is investing in customer experience worth it? In an attempt to answer some questions, we compared stock returns of customer experience leaders (assessed via the Forrester Customer Experience Index) against the S&P 500. Is investing in customer experience worth it? View the results below and judge for yourself.

As mentioned, customer experience leaders were identified using Forrester’s 2014 Customer Experience Index (CXi). Forrester sorts their customer experience leaders by industry.

-

The public firm with the highest CXi score in each industry was selected for our study. Only one firm from each industry was chosen.

-

The firm had to have at least 10 consecutive years of publicly traded stock prices. If the highest performing firm had less than 10 years of stock prices, the next highest ranked firm with at least 10 years of historical prices was selected.

-

Each firm had to achieve at least a “good” CXi rating (score above 75). If an industry did not have a public firm with at least a “good” rating and 10 years of publicly traded stock prices, that industry was not included in the study.

Eight firms were selected from the following industries: airlines (Southwest Airlines), consumer electronics (Amazon), credit card providers (American Express) , hotels (Marriott), investment firms (TD Ameritrade), retailers (Kohl’s), package delivery services (UPS), and wireless service providers (Verizon). To calculate returns, we took the adjusted close price for each stock and for the S&P 500 from July 2004 to July 2014. All CXifirms were weighted equally to negate differences in stock price.

Customer experience leaders posted an average ten year return of 213% and almost tripled the S&P 500 return (75%) over the past decade. It’s no surprise that the company with the greatest ten year return was Amazon (704%). Recalculating the return without Amazon, leading CXi firms still outperformed the S&P 500 by nearly double (143%). Additionally, only one CXi leader (Kohl’s) failed to outdo the S&P 500, posting a 28% return over the period.

The members of the Customer Experience Practice at West Monroe Partners are doing more than just helping clients provide effortless, multi-channel experiences… we’re helping make the world safe for capitalism. Good Customer Experience…Good Karma…Good Business.