Feb. 1, 2019 | InBrief

Are you optimizing your customer investments to drive retention and growth?

Customer retention cost (CRC) and customer expansion cost (CEC) metrics can help organizations through investment decisions and performance assessment

Are you optimizing your customer investments to drive retention and growth?

Existing customers are the new growth engine. As such, gross and net retention have become fundamental SaaS metrics – but how much are you spending to keep and grow your customers and drive overall retention performance? Are these investments yielding appropriate returns?

Established SaaS companies typically spend over 35% of revenue on sales & marketing and emerging SaaS companies often spend much more. However, minimal visibility into this spend and the yield on this spend exists today.

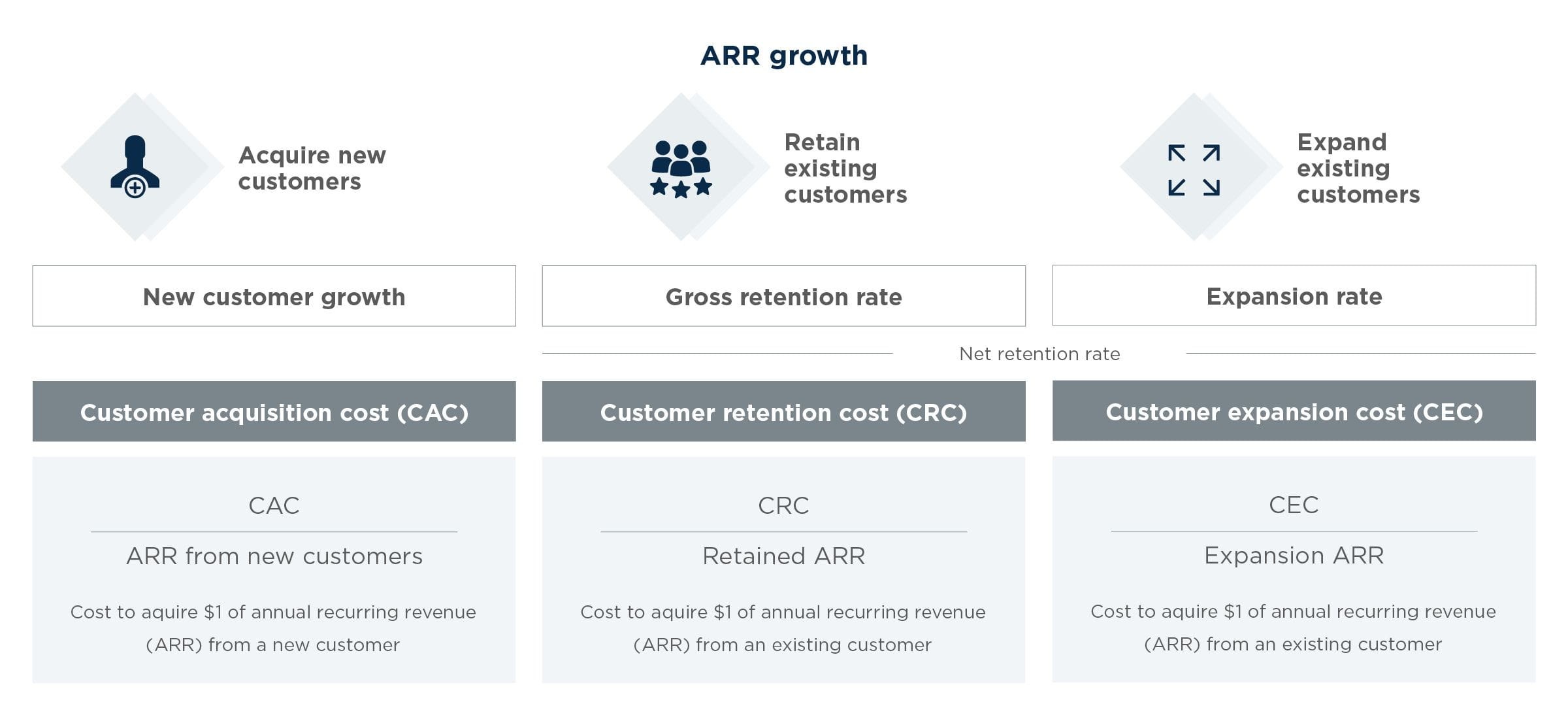

While traditional CAC (Customer Acquisition Cost) metrics have been widely adopted and do a good job assessing overall Sales and Marketing efficiency, they don’t provide the necessary insight into the unique growth drivers of a SaaS business: 1) new customer acquisition 2) customer retention and 3) customer expansion.

Introducing CRC and CEC

Traditional CAC metrics are evolving to align with subscription growth drivers:

- CAC: cost to acquire new customers

- CRC: cost to retain existing customers

- CEC: cost to expand existing customers (upsell/cross-sell)

As illustrated in the visual below, CRC and CEC underpin gross and net retention performance.

Evaluating the ratios of these costs relative to their corresponding revenue can help you gauge the growth efficiency of your organization and guide operating investments and decisions across the customer lifecycle. These ratios ultimately help address key strategic questions:

- How efficient are we in acquiring, retaining and expanding customers?

- Are there opportunities to prioritize spend differently across the lifecycle to improve return?

- How do we balance tradeoffs between customer growth costs (CAC, CRC, CEC) vs. OI targets?

Defining CAC, CRC and CEC

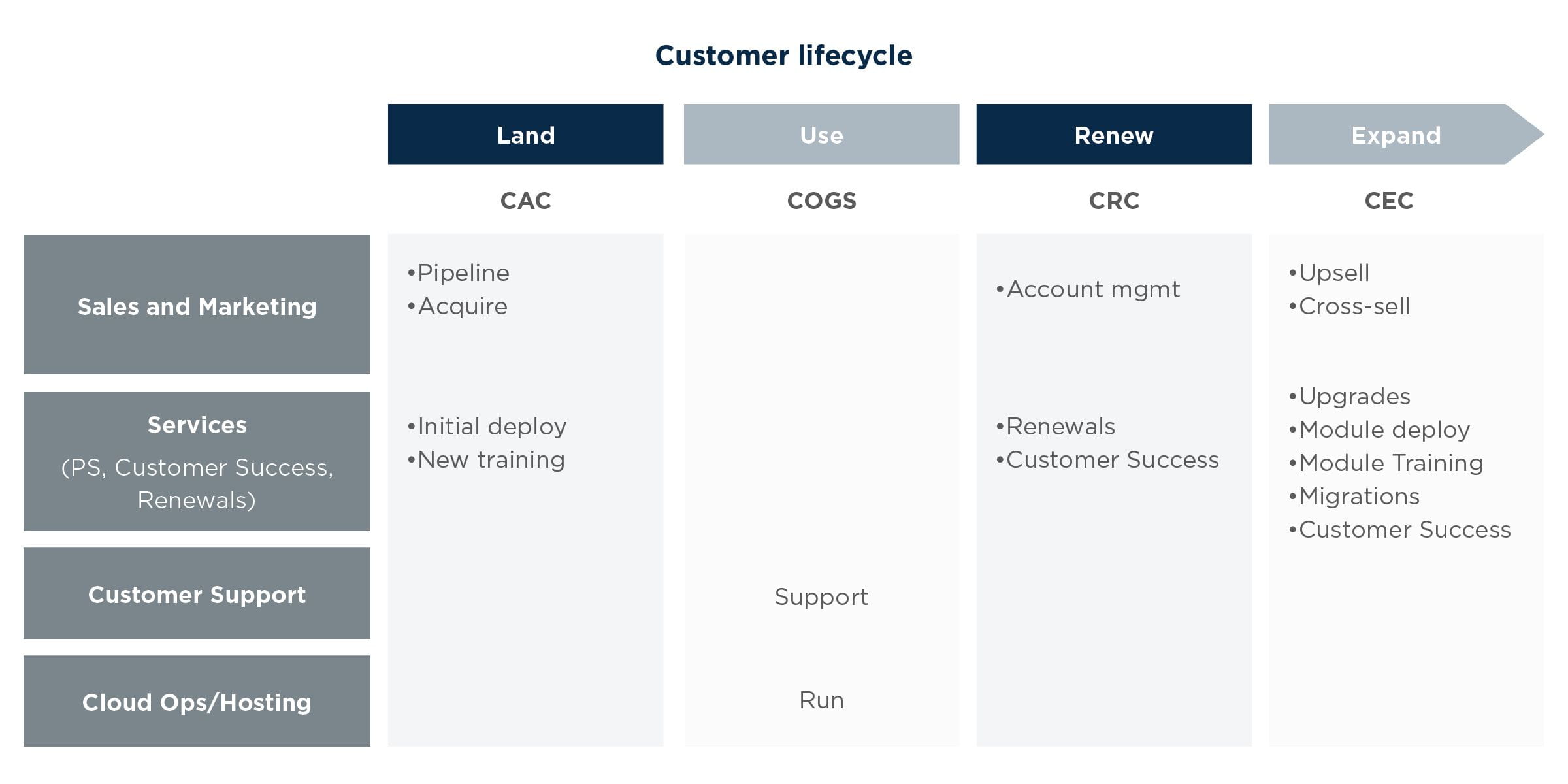

Traditional CAC metrics are calculated based on total S&M expenses as a proxy for “acquisition” costs. However, not only do S&M expenses span “retention” and “expansion” activities, but there are other functional costs involved in acquiring, retaining, or expanding your customer base as well.

While Sales plays the lead role in driving growth, Services plays a key supporting role. Professional Services, Customer Success, and Renewal functional costs must also be accounted for when calculating your CAC, CRC, and CEC ratios. If your Services organization is revenue generating, you should offset Service expenses with Service revenue to calculate a net service spend.

Cloud Ops and Support (part of COGS) are needed to keep the product running and, as such, are typically excluded from analysis. Non-customer facing organizations (i.e. R&D, G&A) are also excluded from the analysis.

Once your functional costs are defined, these costs need to be allocated across the customer lifecycle. The visual below helps give you a sense for how S&M and Service costs are allocated across the lifecycle.

It is important to note that assumptions and estimations will likely be required to segment activities into new, retention, and expansion activities given shared resources (e.g. the cost of a sales rep that is compensated for both landing new customers and upselling existing). The key is to focus on the major cost drivers and be consistent in your methodology.

Getting Started

As companies transition to their next stage as a cloud company and focus further on customer experience and growth, we suggest adding CRC and CEC thinking and metrics to guide investment decisions and performance assessment.