The evolution of distributed energy resources: 2015 and now

In 2015, we took an in-depth look at how utilities, consumers, and regulators viewed distributed energy resources (DERs) and the impact they can be expected to have on the grid, and utility operations. We recently returned to the market with some additional research questions to compare results from the previous study effort and to gain new insights.

The rapid proliferation of DERs is the most obvious manifestation of the quickening evolution of the grid away from the traditional hub-and-spoke model toward a more distributed and networked industry model. Driven largely by state policy, financial incentives, and customer demand, this influx of solar, smart thermostats, electric vehicles (EVs), battery storage, and other DERs is fundamentally reshaping the electricity industry.

Operating the grid becomes more challenging as more DERs are added. However, DERs also provide greater flexibility for meeting load. As utilities move toward distributed energy, the customer’s role in the energy value chain increases dramatically. The utility’s ability to influence mutually beneficial DER adoption and behavior will help dictate whether or not DERs serve as an opportunity or threat.

Evolving the Distributed Energy Resources (DERs) landscape

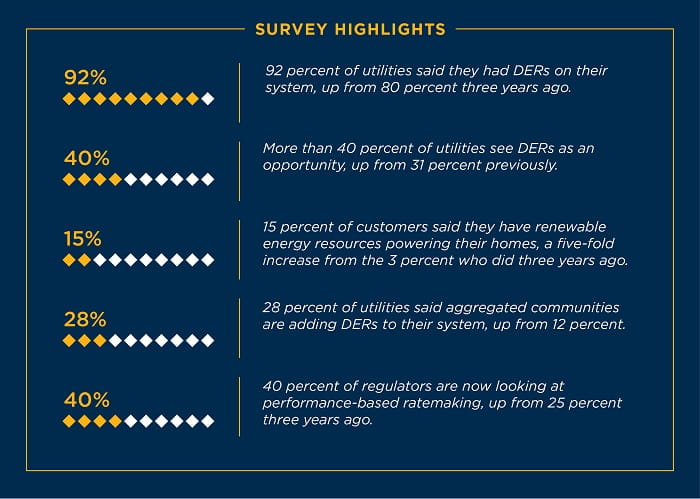

In a few short years since the 2015 survey Keeping the Lights On, there has been an increase in the types of DERs connected to the grid across utilities of all sizes and geographic locations in North America. In our recent research report, Planning for a Distributed Energy Future, we took a comprehensive and linear look at how customers, utilities, and regulators view this transformation.

Latest survey results indicate that the necessary actions and planning required by regulators and utilities to accommodate the wave of DER additions are beginning to take place. But, simultaneously it is not at the pace required to be ahead of customer adoption rates.

A Growing Opportunity

Even so, the survey results reveal that utilities are poised to rise to the challenge. More utilities now see DERs as an opportunity than four years ago, and many are making foundational investments to gain better visibility into DERs on their systems to understand when a potential tipping point might be reached.

There are several likely reasons explaining why DER planning by regulators and utilities is lagging that of broader customer adoption. This includes whether utilities can own generation or DERs, how much demand there is from customers, and public policy and regulatory factors in support of DERs.

In some cases, it may simply be a matter of DERs being spread out across the grid in such a way that the impacts are either not noticeable or are focused on just a handful of circuits. For utilities and regulators, that leads to a logical conclusion that if only one or two circuits are impacted by DERs, why make system wide investments, when smaller local investments will suffice.

Inaction has its own risks

Allowing DERs to proliferate without proper utility and regulatory planning can generate large risks in maintaining a safe and reliable electric for all customers—e.g., mass electrical vehicle charging during coincidental peak times, insufficient hosting capacity for DER installations, accommodating overgeneration of rooftop solar during times of low demand. Additionally, third-party players on the periphery are coming up with solutions that customers are asking for—if utilities don’t quicken their pace, opportunities will be lost.

By contrast, advanced planning by utilities and forward-thinking regulators can create an environment in which utilities, third parties, and customers can all take advantage of the opportunities presented by DERs.

No matter what the DER penetration is today, the next few years will be extremely important for utilities. Take a look at our Planning for a Distributed Energy Future white paper for a deep dive into what’s changed between 2015 and now, and where we are headed with the DERs.