February 2019 | Point of View

Become cloud-ready: Prepare for the inevitable on your financial institution's terms

We lay out concrete and practical advice on how to become cloud-ready so your financial institution is able to accelerate your use of the cloud on its own terms

Become cloud-ready: Prepare for the inevitable on your financial institution's terms

The financial services industry lags other sectors in its use of the cloud. Yet, as digital transformation progresses, more institutions are finding themselves at an inflection point—such as a major software upgrade or termination of a managed services contract—that requires them to begin shifting to a hybrid infrastructure. Readiness for this change is essential. Without the proper foundation in place, operating in a hybrid environment can elevate the challenges of aggregating data and creating that vital 360-degree view of customers.

Whether or not a financial institution is ready to begin operating in the cloud, it needs to be thinking about and preparing a cloud migration approach with guiding principles, skills, oversight, and technology architecture that will facilitate an efficient transition. Those that wait may find their path dictated by vendors rather than being able to make the move on their own terms.

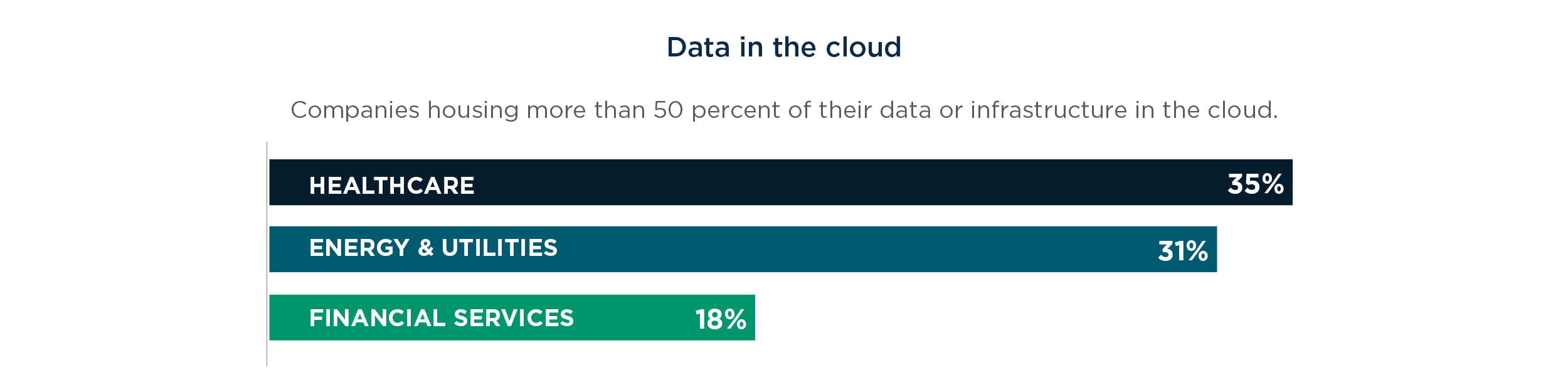

In early 2018, West Monroe surveyed business and technology leaders to identify and quantify gaps their organizations must close in order to survive and thrive in the digital age. One area of focus was operating in the cloud. Responses from financial services executives revealed that the industry’s use of the cloud lags that of other sectors, such as utilities and healthcare.

Much has been written about how mid-sized financial institutions can benefit from moving assertively toward a hybrid infrastructure, not the least of which is achieving the agility necessary to respond rapidly to change, differentiate within the market, and compete effectively with other middle-market financial institutions. We believe there are compelling reasons why your financial institution should be accelerating its use of the cloud. But we know you know that. There are plenty of articles that expand on the benefits. This is not one of those.

Rather, this is about the “hows.” If your institution is like many others, the real issue is how to make the leap with confidence. The purpose of this paper is to layout concrete and practical advice for a cloud migration approach so that your financial institution is able to accelerate your use of the cloud—and do so on its own terms.

4 Elements to Becoming Cloud-Ready

Every institution has unique considerations for moving applications to the cloud. The common denominator for all, though, is to have a foundation that is in place when the time is right for cloud migration. For most organizations, that “right” time is the result of an inflection point, such as a planned hardware refresh, the upcoming termination or renewal of a managed services or other contract, a major software upgrade, or internal demand for access to modern development or other tools available primarily via cloud platforms.

From our experience working with institutions of all sizes, we have identified four key elements that comprise a cloud-ready foundation. Focusing effort to develop these four areas will go a long way toward streamlining your path to the cloud—whether you have already started, are about to, or are thinking about it.

1. A big picture plan that provides guidance for specific cloud initiatives

Most institutions that are using the cloud today started doing so organically —pursuing a point solution such as a modern loan origination system, online banking platform, or cloud-based core banking system. There is nothing wrong with this approach to cloud migration; in fact, every organization needs to start somewhere. But when repeated over time, working point solution to point solution leads to disparate and uncoordinated activity. That will complicate operations when the institution then needs to begin coordinating all of these efforts in order to aggregate data from multiple platforms, which is essential if the institution aspires to become a data-driven organization with a 360-degree view of its customers. Think of it like spilling a jar of gumballs and then rounding them up to put them back in the jar— chasing one gumball, then another, and then another. In addition to missing opportunities to maximize benefits, the organization is likely to invest a lot more than it needs to in both internal and vendor costs.

Even when beginning small, it is beneficial to work in the context of a basic plan that reflects your organization’s key strategy for leveraging the cloud. The goal should be to have a plan that looks at your institution holistically and aligns your cloud migration approach with organizational strategy.

- The decision points below can help in building that big picture:

- Where does the cloud enable us to innovate, advance digital transformation, or achieve operations excellence?

- Where does modern cloud architecture support integration of FinTech so that we can expand horizontally and/or offer new products and features?

- To what extent do we outsource services today and how comfortable are we with doing so? Many financial organizations have been long-time consumers of outsourced services such as service bureaus; accordingly, the shift to cloud operations may not be as big of a stretch as you think if you have mature vendor management and third-party risk management practices in place.

- What advantages could cloud operations provide over traditionally hosted applications? Typical cloud benefits include reduced maintenance and upgrade requirements, more favorable consumption-based costing, and improved tool sets and services.

- How do cloud providers manage cybersecurity (e.g., Are they GLBA compliant?), and how does that change or impact our institution’s cybersecurity requirements?

2. People who are ready and able to support cloud operations

Operating in the cloud isn’t just about technology. In fact, success with the cloud is as much about people as anything else—specifically, eliminating resistance and making sure that people at all levels are prepared to support the change. When an organization is working with a bias toward action, it is easy to gloss over the steps needed to bring people along with the change. Recognize that cloud adoption is like any major organizational change initiative: People need to understand where the organization is going, why this is important, what it means for them, and what’s in it for them. Take time to formalize your vision and values and guiding principles for using the cloud, as that will be necessary to building support at all levels.

Managing cloud operations will require skills that vary greatly from those needed to manage current architectures, often mainframe-oriented core systems. You will need individuals skilled in key platforms, such as AWS or Azure, as well as managing cloud instances and hybrid operating environments. You will also need people who understand how to modernize applications in order to leverage platform-as-a-service (PaaS) platforms.

These skill gaps are difficult to identify and easy to underestimate. Furthermore, these gaps tend to be greater in financial organizations than other industries, for several reasons: the relatively low cloud adoption rate to date (and dependency on vendors where cloud-adoption has occurred); continued reliance on older and/ or self-built solutions; and tenured technology teams that remain oriented toward operating and maintaining legacy systems rather than building modern skills. As a starting point, you will need to assess the readiness of your people. Where do you have the skills that support the strategy, and where will you need to hire or develop skills?

Additionally, your organization must be prepared to invest in the necessary training and development. Without this preparation, people will be a limiting factor.

Based on your answers to questions in step 1, you can document the basic guiding principles that will aid in making decisions for specific initiatives:

Why we want to operate in the cloud

- Strategic goals such as increasing agility, improving ability to integrate FinTech products in order to drive new product offerings, or reducing the need for internal infrastructure

- Benefits we want to realize by adopting cloud technologies, such as increased competitiveness

- Anticipated constraints that the institution must overcome to operate in the cloud, such as skills readiness, organization structure, or maturity of vendor management/governance practices

What part of our operations will run in the cloud, and where

- Key applications that are candidates for cloud operation

- Potential risks that we must consider when moving those applications to the cloud

- Cloud technologies that may be appropriate for future use

- The criteria we will use to decide what to operate in the cloud and the process for periodically revisiting those decisions to ensure they are optimized

Who must be involved in cloud adoption

- IT and business leaders who will make strategic decisions

- Key business stakeholders and teams that will have responsibility for executing cloud strategy and providing ongoing oversight governing usage and cloud spend

- IT resources that will support and implement cloud technologies and may need to acquire new skills, change operational process, and transform internal organizational groups to effectively manage cloud platforms

When we will make the move

- Timelines and sequence for people, process, and technology changes

- How we will synchronize functional investments with strategic goals and business strategy

3. Updated governance & risk management approaches

Some traditional barriers to financial services operations in the cloud—namely regulatory and security concerns— are diminishing as the technologies mature and regulatory familiarity increases. Driven in part by the FedRAMP initiative, which is encouraging a standardized approach for managing security for the cloud, federal regulators are now working with providers to remove barriers so that financial institutions can seriously consider cloud operations. In fact, regulators increasingly expect to see that financial services organizations have a sound cloud strategy in place.

More and more, our conversations with clients are centered around how to adapt and extend risk management and vendor processes to accommodate for cloud operations. Cloud adoption shifts some risk from the institution to the vendor because the platform increases the involvement of third parties in managing security controls, some of which may impact compliance requirements such as GLBA. Accountability for risk and governance, however, remains with the institution. It is important, therefore, to have and be able to show regulators a mature approach for vendor management and shared risk responsibility.

Cloud platforms often present new questions around managing and governing data. Cloud governance should be supported by a mature data governance program. To manage how data in the cloud will integrate with legacy platforms, these data governance programs should include clear definitions of ownership/stewardship of data and prescriptive playbooks for reconciling and mastering data.

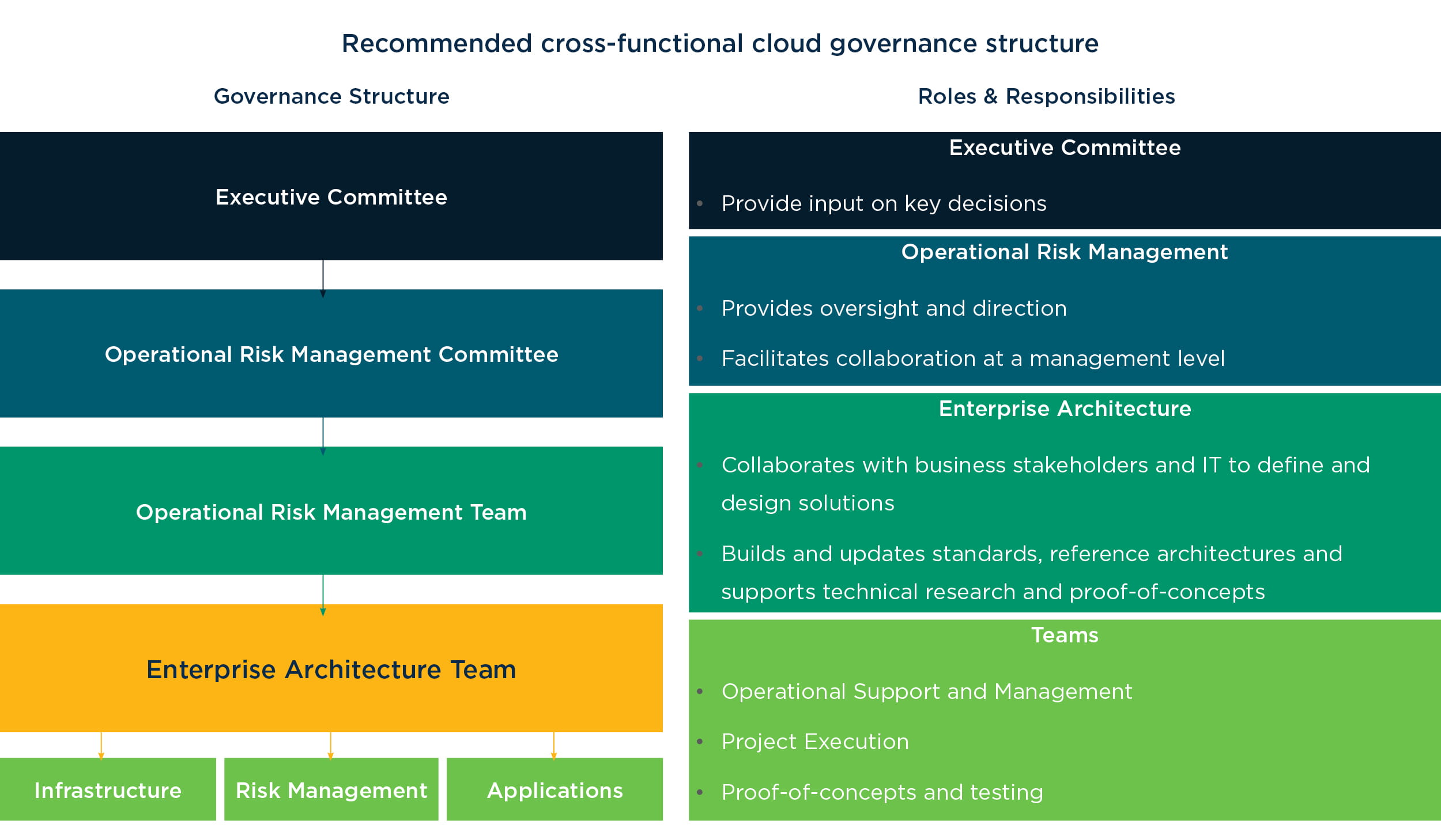

Establishing a cross-functional cloud governance structure, with defined roles and responsibilities, is an important part of a scalable cloud foundation.

4. Technology foundation and architecture

Finally, it is prudent to invest early in the foundational technologies that allow you to operate, manage, and secure data and applications running in the cloud. Such high-level decisions ensure that specific initiatives start in the right place—for example, if you are selecting a SaaS-based platform to support loan origination that it will integrate effectively with your core platform and systems. This exercise should include defining reference architecture and patterns for how you will configure and operate cloud applications and manage data.

Focusing on these three pillars in your cloud migration approach can help your institution build a flexible foundation:

Integration: The ability to integrate data securely with on-premises and other cloud services becomes critical to realizing value as adoption of SaaS services and hosted or partner solutions increases. Using a service-oriented architecture platform, either on premises or in the cloud (Dell Boomi, Oracle SOA, etc.), can form the backbone for a plug-and-play approach to cloud adoption.

Data and analytics: Traditional data warehouse architecture may struggle to properly incorporate data feeds from partners or SaaS applications due to the varied levels of support. Institutions should evaluate the potential value of data lake or other analytic architectures that offer flexibility for incorporating source data, as well as cloud-friendly storage and analytic tool sets to help rationalize data.

Security and identity: Establishing a standard approach for identity and access management is key to reducing the complexity of cloud or partner services. This creates a single identity structure for organizations (Azure AD, Okta), with both a single sign on experience for users and a simplified control structure for management and audit.

The time to prepare is now

This preliminary emphasis on your cloud migration approach may seem like a grandiose exercise at a stage when most financial organizations are taking baby steps in the move toward the cloud. The point we want to stress is this: If you put the right foundation in place now, you will be able to approach cloud migration proactively and on your organization’s terms. You will also be able to do so as efficiently as possible—i.e., you won’t need to chase and corral a bunch of “gumballs.” If you wait, your path will be dictated by vendors that have already moved platforms to the cloud, forcing your institution to make the move on their terms. And it won’t be too far into the future when financial institutions without a cloud strategy and approach find that the FinTech wave is passing them by, leaving them behind their competition in the market.

So, whether you are still considering making the leap or are doing so cautiously, investing now the right foundation will allow you to accelerate when you are ready to move at greater speed.