April 2020 | Point of View

A 20/20 view of cost takeout as manufacturers face COVID-19

A 20/20 view of cost takeout as manufacturers face COVID-19

The economic realities of COVID-19 suggest significant demand shrinkage in the second quarter that will likely stretch into the second half of 2020. Since it is too early to tell when recovery will begin, manufacturers are scrambling to preserve cash and right-size their operating costs with dramatic cost-takeout efforts in the face of two dynamic challenges:

- Adapting to the needs of a safe work environment due to social distancing

- Overcoming unprecedented demand volatility and industry segment shifts

With what is believed to be a 25%+ reduction in global GDP, manufacturers are already rushing to reduce the cost base in the face of unprecedented global economic disruption. No historic precedence exists to inform a path forward and, because of this, there is no macro-economic playbook to weather this particular storm. The natural reflex for manufacturing firms is to apply a “cut-and-cope” approach for direct and indirect labor. This comes from the conventional view of operating costs:

Conventional wisdom to cost takeout

Cost to Serve = Raw Material + Labor + Energy/Utilities + Plant Equipment + SG&A, etc.

Labor continues to be the easiest and quickest lever to pull for immediate cost takeout. Making these immediate cuts, however, will undo many of the efficiencies that had built up during the previous economic boom when payrolls grew and the labor market was tight. Furthermore, we do not yet truly understand the role that employee and customer safety will play across the enterprise post-COVID-19. To truly understand the drivers of your cost to serve beyond the typical P&L categories and still enable a less disruptive and more adoptive right-sizing of costs in the face of the COVID-19 challenges, we offer a different view on operational dynamics to consider.

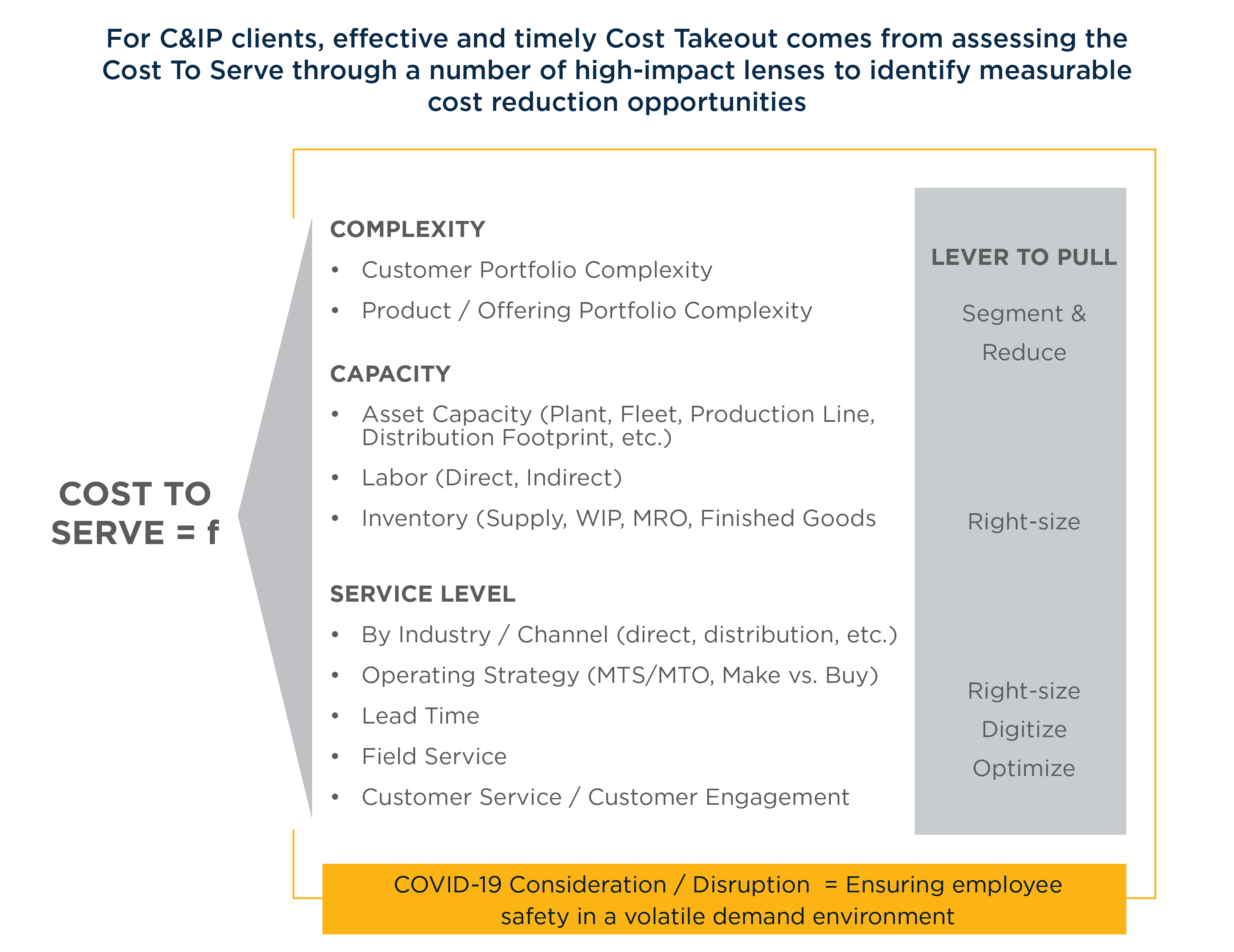

20/20 view of operational dynamics to cost takeout

Cost to Serve = f(Complexity, Capacity, Service Levels)

In order to best execute an effective right-sizing strategy, manufacturers should first understand the true dynamics of their operations and their related costs (both operating costs and working capital). This operating cost basis is largely based around the function of three different yet measurable and impactable dynamics. Let’s take a closer look at each of these dynamics and why they are important to enable a nimble cost takeout adoption plan.

1. Complexity

Complexity across both customer and product portfolios is an anchor of cost to serve. The spread of customers (from large to small) and an understanding of a fundamental (volume and/or revenue-based) segmentation of customers and products provides a good reference point of where the core of value and cash flow will come from. Manufacturers should test the true value of servicing small, low-volume customers and products. The 80/20 rule holds serve here and provides a useful scale in segmenting and if needed, rationalizing small, low-value customers and products. Further, understanding the real cost impact of servicing “the long tail” of small products and customers makes adopting segment-specific policies a mathematical exercise, not an emotional one.

2. Capacity

This goes far beyond plant capacity but encompasses the total resource capacity of a manufacturing enterprise. The added consideration when assessing capacity is the near-term and, likely, medium-term employee and customer safety requirements and protocols due to social distancing. The resource capacity to consider and assess are:

- Asset Capacity: Plant, fleet, production line, storage/warehouse/distribution, office

- Labor Capacity: Direct and indirect labor that includes shop floor operations, distribution, back office, engineering, customer service, field service

- Inventory (working capital):Raw materials, packaging, WIP, MRO, and finished goods

Truncating capacity, most notably labor capacity, is the typical route firms take when quickly taking out costs. Considering challenges and inefficiencies that the need for employee and customer social distancing brings, going beyond the typical reduction in force playbook will be needed. While a pivot to work-from-home has been quickly enabled, the longer-term impact of personal protective equipment, plant shop floor, common area and meeting space protocols, and customer/field service requirements are still being determined and adopted. The impact on overall resource capacity and the potential for digital enablement, automation, and distributed control and surveillance capabilities will rapidly evolve and likely be the area that experiences the greatest transformation long after industries have recovered from this COVID-19 disruption.

3. Service levels

In light of the personal contact and safety challenges posed by COVID-19, accurately determining the cost to serve of customer service, order fulfillment, issue resolution, and field service execution has become even more difficult. As manufacturing firms assess the impact of complexity and right-size capacity levers, the next major area to consider is reviewing and adapting operating strategies and service policies. Service levels by channel, digital enablement, e-commerce, and even adjusting lead-times should all be considered as fair game. Right-sizing complexity in the face of unprecedented demand volatility may require a review of make to stock (MTS) and make to order (MTO) S&OP policies. In the face of recent and likely long-term supply reliability challenges, make vs. buy or onshoring strategies will also be considered. Developing customer and field service protocols in the midst of employee and customer safety requirements while reducing field service and customer service staffs in line with demand shrinkage will undercut your ability to remain competitive and responsive while recovering, adapting to the changes, and transforming to new ways of working.

Looking ahead

While maintaining a safe workspace for both employees and customers in the face of overwhelming uncertainty and demand volatility, manufacturers should break from conventional wisdom when right-sizing costs amid near-term financial challenges. They will be better served to take a holistic approach to cost takeout that considers three operating dynamics over the traditional top-down, P&L, “cut-and-cope” operating cost reduction approach. This will enable them to quickly embrace the new normal and begin recovery efforts despite economic uncertainty.