October 2019 | Point of View

Grow your treasury revenue at above-market rates by investing in client experience

Banks traditionally have invested in better products, sales, and go-to-market process improvements. But client experience is proving to be the key differentiator in treasury management.

Treasury revenue increasingly puts banks in a “winners and losers” scenario where growth is primarily achieved when banks are able to take business away from their competitors. Increasingly, client experience is emerging as the key differentiator for the “winners” in this scenario.

- In our 2018 report, “Make It Easy: In Treasury Management, Client Experience Rules,” treasury clients named an “easy” client experience as the most important factor in retaining or growing their relationship with their bank. While there is no doubt that improving the client experience is a multifaceted challenge, addressing client experience challenges is critical for any bank that wants to compete effectively.

- Applying an “easy banking” lens to the commonly used 4 Stages of Net Revenue Growth presents banks an opportunity to assess their financial performance in relation to their client experience.

- A bank’s ability to grow comes into much sharper focus when seen through the lens of the core characteristics of a stellar treasury client experience.

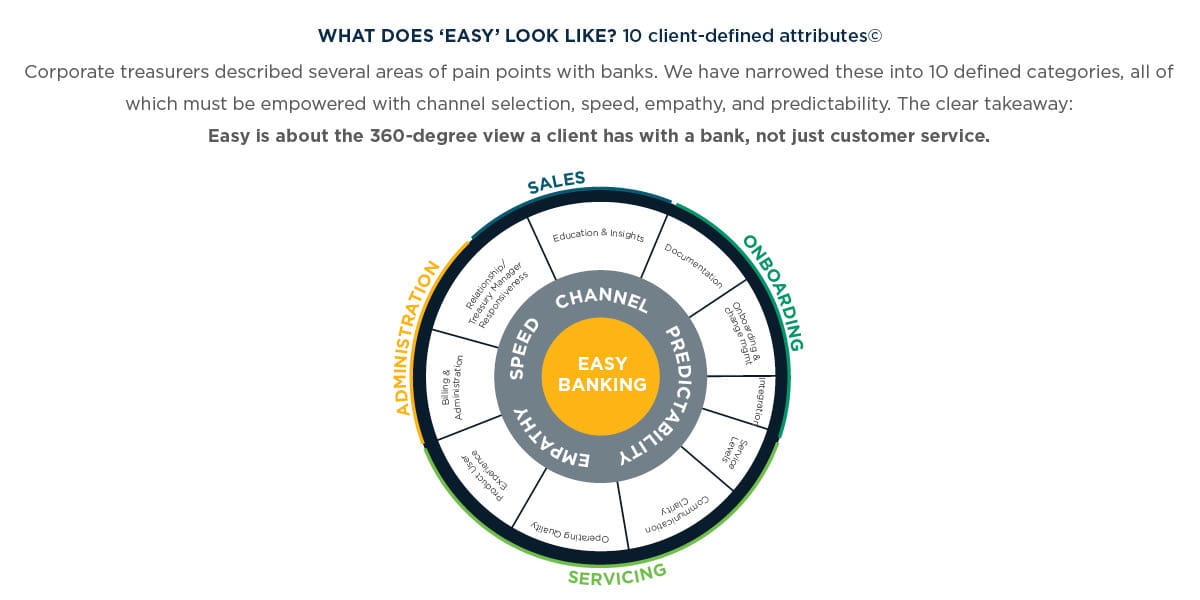

- An easier experience goes beyond client service. It includes every touchpoint, starting with the sales process and continuing with onboarding, servicing, and administering an ongoing relationship, including the consultative services banks provide to help the client succeed. The challenge is daunting, but imperative for banks to address that want to grow their treasury services.

Introduction

Client experience will determine who wins and who loses in the zero-sum world of treasury services.

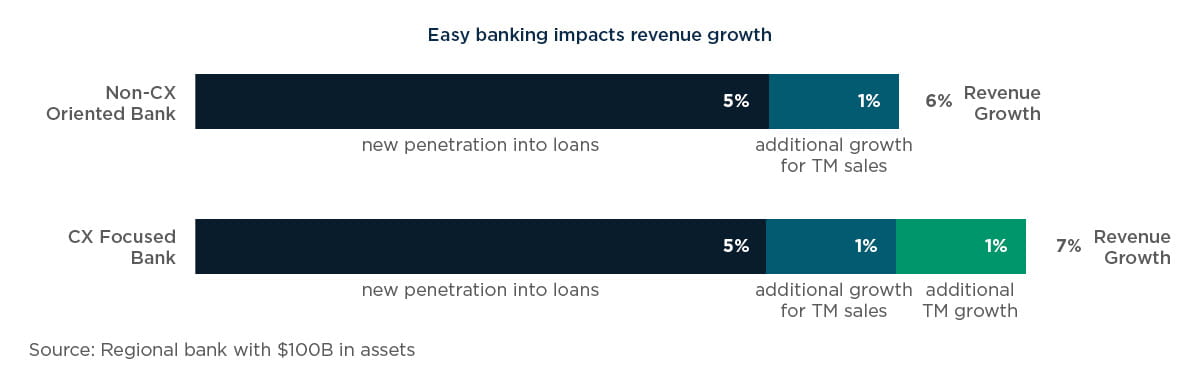

On average, industry growth rates for treasury services correlate closely with the nation’s GDP changes. “Average growth” is the critical term here: The top banks in the country continue to increase overall market share, meaning there is a significant gap between those growing at above- average rates and those growing at below-average rates. For banks with targets above the industry average, any growth must presumably come from a “winners and losers” scenario where banks are taking business from their competitors.

Banks have traditionally invested in better products, sales and go-to-market process improvements, and experienced sales and support staff. We think these are still important investments. But, the difference between the “winners and losers” for banks of all sizes is increasingly pointing to a better, “easier” client experience (CX).

In our 2018 report, “Make It Easy: In Treasury Management, Client Experience Rules,” treasury clients named an easy experience as the most important factor in retaining or growing their relationship with their bank. To be sure, improving the client experience is a multifaceted challenge that touches virtually every aspect of client interaction, and often means confronting entrenched structural and leadership issues within the banks. But, addressing these challenges is critical for any bank that wants to compete.

Knowing the premium placed on CX by clients, to grow your treasury revenue at above-industry rates, investing in your client experience is essential.

Chapter 1: An easy CX is the key to cross-selling treasury business into new clients

Stage 1

There are several ways banks win new business from new clients. Traditionally, these include securing credit-driven wins from new lending deals coupled with treasury services, pricing strategies to undercut competition, better product capabilities, and providing insightful solutions to clients’ treasury management pain points. A 2018 CGI study of global treasurers supports West Monroe’s research when they found the No. 1 factor considered by organizations when establishing a banking relationship is easy integrations into back-office systems and processes.

There are certainly no surprises here and all are included in our own 10 Principles of Easy Banking. But, big banks have a clear strategic advantage over the mid-market—spending time, resources, and money on technology, employee training, and CRM platforms to drive and retain customer insights. The mid-market, on the other hand, reports obtaining the bulk of their new client business from cross-selling into loan relationships. The mid-market also places less emphasis on winning new treasury-only relationships, without an existing credit product in place. In this environment, the mid- market will often significantly discount prices to get the treasury business to move to their bank.

Given these widespread practices, easy CX is an essential component to attracting new treasury clients. For treasury services, new customer acquisition depends on:

1. The client’s current experience with other commercial products and services:

- Service quality and the timely resolution of inquiries

- Consistency of communication and relationship ties

- Bankers that understand the customer, its objectives; and the client’s industry needs and trends

2. The ability to demonstrate the ease of transitioning and onboarding the client:

- Speed, communication, overall simplicity

- Data integration capabilities

3. Your bank’s reputation for providing an easy transition process:

- Track record for being “easy” to do business with

CX may not be the leading requirement for business growth into new relationships but it is a leading factor for a bank’s ability to acquire new treasury clients once initial loans are booked.

“Easy” action plan for boosting treasury client acquisition

- Measure and require cross-sell of treasury services into the C&I loan book.

- Redesign selling and loan booking experience to improve ease and gain the cross-sell business.

- Build your market brand as an “easy” bank for corporate clients. Clients trade notes and they know which banks deliver an “easy” experience and those that do not

Chapter 2: Easy CX leads to cross-selling and deeper client relationships

Stage 2

Cross-selling and upselling TM into loan customers is a critically important strategy for mid-market banks, but is often not well-executed and rarely measured as a key performance indicator. What is more, the ability to cross- sell treasury services into loans greatly depends on the factors associated with a great CX.

Banks with a proactive CX management program can expect four to five times the cross-sell penetration as non-actively managed banks.2 In our own 2018 study, respondents stressed that user experience is the top factor in boosting client loyalty and relationship growth— trumping relationship manager capability, service, credit availability and even price. As one senior cash manager for a large global corporation indicated, “I am absolutely willing to pay more for easy. Make it easy and I shift into buying mode; when I know it’s hard, I shift into ‘defer it’ mode. Easy CX matters significantly.”

Cross-selling wins typically come from three dimensions:

1. Organic customer requests for new services.

From our own research, we know that new business by and large goes to banks that provide an easy client experience. As one respondent said in our 2018 report: “Easier is faster, and faster is more efficient, so all new services went to the banks that were easy.”

2. The ability to solution or sell products and services that either solve problems or meet objectives for the client.

3. Predatory pricing strategies, where banks undercut the pricing of other banks in the client portfolio.

Because of the premium placed on an easy client experience, banks that don’t address poor experiences stand to lose-out in any competition for new clients.

We posit that a primary “hidden” financial benefit of an easy CX is its ability to promote organic requests for new services from a happy customer base.

“Easy” action plan for boosting treasury across selling

- Perform frequent account reviews as a best practice.

- Maintain effective communications and relationships with your customers—know their industry, their business, and their business objectives so you may be proactive and intuitive.

- Be highly responsive and timely to inquiries.

- Redesign and monitor documentation and the onboarding process to ensure it’s easy.

- Provide fair and simple pricing.

Chapter 3: The CX impact on pricing, credits, waivers

Stage 3

Based on our decades of experience in the treasury industry, we believe good CX should provide at least a 3% price increase each year and another 3% decrease in waivers and discounts. A 6% increase in revenues exceeds the goals of many regional banks—without selling any new business. And if we compound a 6% increase over 5 years, it produces 16% more revenue than a bank that does not get any increases.

Any bank client will expect reasonable price increases over time, and most are willing to pay for those when the bank’s value is clearly demonstrated. Yet, when the bank’s value falls short, client attrition typically follows. Often, client attrition is passive with clients no longer approaching the bank for new services. These missed opportunities to deepen existing relationships is another hidden cost not reflected in a bank’s financial reports. As one treasury client told us, “Easy is a top criterion for us. It drives our decisions. We are willing to pay for quality relationships that make our life easier.”

A bank’s value is not determined by a product alone, but the overall client experience including the quality of relationship management. If the client experience is less than stellar, bank customers will be less likely to absorb occasional price increases. Additionally, if the customer experience is difficult, the minimization of pricing waivers and credits will not provide enough annual increases to be a financially strong treasury services line of business.

“Easy” action plan

- Providing value through a great customer experience pays for itself with annual price increase and fewer pricing discounts.

Chapter 4: Retention and run-off

Stage 4

Treasury management business is in a continuous state of churn. As banks win new deals, business may also be flowing out the back door through run-off. For some banks, run-off can wipe out the positive effects of the sales and relationship management teams. In many cases, treasury run-off isn’t detected as bank customers tend to parse out pieces of the treasury services to other banks.

Run-off typically comes from four dimensions:

1. Credit-driven: The bank or client exits the credit product, so client moves treasury business to the new credit bank.

2. Competitor-driven: A competitor outsells the bank and takes portions or all the treasury business.

3. CX-driven: Lackluster CX provides reason to leave the bank.

4. Pricing: Services are overpriced.

Our experience is that most banks do not adequately measure run-off, the causes of the run-off, nor the financial impact. If it isn’t monitored and measured, it can’t be appropriately managed. This is a basic gap in most banks’ management and financial reporting.

Run-off is usually not an all or nothing deal. Through solid management and understanding of the causes of the issues, and a proactive approach to making the right changes, some or all the business can be retained.

“Easy” action plan:

- Designate an executive to own the end-to-end customer experience

- Measure, monitor and proactively manage at risk customers

- Minimize CX pain points to reduce excuses to leave the ban

Conclusion

The costs of not being easy to work with is increasingly affecting a bank’s short-and long-term profitability. In light of the priority placed on easy CX in treasury services, we would urge banks to take an active role in measuring their CX’s impact on profits, customer loyalty and growth.

Any bank seeking to differentiate via an easy client experience must first develop a client-centric operating model via the following recommended steps:

- Develop a client-first strategy for delivering value: Define your North Star client experience and identify near- and long-term strategies to achieve it.

- Measure and benchmark ease of doing business: Start with a strengths and weaknesses assessment and apply the findings to a capability maturity model across strategy, technology, leadership, governance, and culture.

- Build governance and leadership to hold people accountable: Banks must make the shift from short-term cost-cutting to longer-term goals around improving client experience and hold all leaders accountable.

- Change the bank’s culture: Firms must champion company-wide buy-in vs. leaning on the heroics of individual team members to deliver a stellar CX.

- Consider client experience when upgrading systems: It is essential to prioritize upgrades that can improve the ease of doing business.

An easier experience is much more than client service. It includes every touchpoint, starting with the sales process and continuing with onboarding, servicing, and administering an ongoing relationship, including the consultative services banks provide to help the client succeed. The task is no doubt daunting but addressing client experience challenges is an urgent matter for any bank that wants to compete effectively.