May 2015 | Point of View

Make customer and partner experience a cornerstone of mergers & acquisitions

Last year, merger and acquisition (M&A) activity finally passed pre- crisis levels and is poised to continue apace in 2015. Thomson Reuters recently released figures suggesting that 2014 was the “strongest year for deal making since 2007,” with some 40,000 announced deals with a cumulative value of US$3.5 trillion. The promise of big financial returns from growth, increased market share, operational synergies, bigger product portfolios, and squeezed competition fuel this feeding frenzy.

However, many mergers fail to achieve their revenue synergy goals and original investment thesis. Why? The most important part of a merger is frequently just an afterthought: the customer and partner experience. For customers and partners, there are many reasons to consider leaving: disruption, possible loss of services or lower service levels, costs to change, strong competitive forces, and an unappealing new brand.

Introduction

While many factors influence merger success, customers and partners—and what they do post- merger—forms the basis of revenue projections, the most important aspect of protecting the value of any deal. Will they stay loyal or will they leave? Will they buy more because they see a better value proposition? Can the acquiring firm meet the expectations of new customers and partners it acquires? Answers to these questions are critical for success, yet firms regularly overlook these while focused on internal factors: financials, IT infrastructure, market objectives, operating synergies, and HR planning. By focusing internally, they overlook the pain and perceptions customers may have about a merger that may make them re- evaluate a relationship and leave, such as lost services, lower service levels, less favorable pricing, or the time and expense required to make process or IT changes.

Companies that get the customer experience right realize enormous rewards. In fact, West Monroe Partners’ analysis indicates that customer experience leaders nearly tripled the S&P 500 return over the last decade. Customer experience is a permission platform for cross-selling products and services; it’s a signaling mechanism for churn; and it’s an indicator of reputation and word-of-mouth that either amplifies marketing messages or creates a headwind against them.

Chapter 1: Firms make several mistakes when customers are an afterthought

When firms feast their eyes on the financial prizes instead of empathizing with the potential pain they cause customers, they make several mistakes.

They make the wrong acquisitions. Strategists make a wide range of financial assumptions based on presumed future customer and partner behavior…but rarely test these assumptions directly with them. Customers and partners are not monolithic, which means they do business with firms for very different reasons and motivations, seeking out distinctive value propositions. For example, Southwest Airlines customers have vastly different expectations of that brand than Emirates customers have of the latter brand. When firms fail to understand what motivates customers and partners because of an internal focus, they risk acquiring a customer base or partners that will churn post-transaction because the company can’t meet their expectations. Furthermore, they may overlook the value (or liability) of customer experience and brand reputation as an intangible asset.

They plan integrations sub-optimally. Integration leaders and their consultants create detailed plans for gaining operational synergies and meeting internally focused goals and timelines, typically without anyone at the table advocating on behalf of what customers and partners need. When integration teams focus myopically on internal needs, they fail to put in place mechanisms to listen to and communicate with customers and partners and adapt plans to their perceptions and needs. The result: customers leave the companies before a deal is even finalized.

They fail to meet investment objectives. When customers and partners end up as an afterthought in strategy and integration planning, firms pay for it in terms of customer complaints (higher costs), dissatisfaction (which hurts marketing and cross-selling efforts), and churn. Level 3 Communications regularly missed financial targets on its acquisitions until it made customer experience a priority and started reporting its Net Promoter ScoreSM (NPS®) out to the financial community.

To identify best practices that put customers and partners at the center of M&A efforts and help companies extract more shareholder value out of the transactions, West Monroe talked to customer-focused leaders involved in merger work at nearly a dozen companies. Following are key insights from these discussions.

Chapter 2: Embed customer experience into the M&A lifecycle

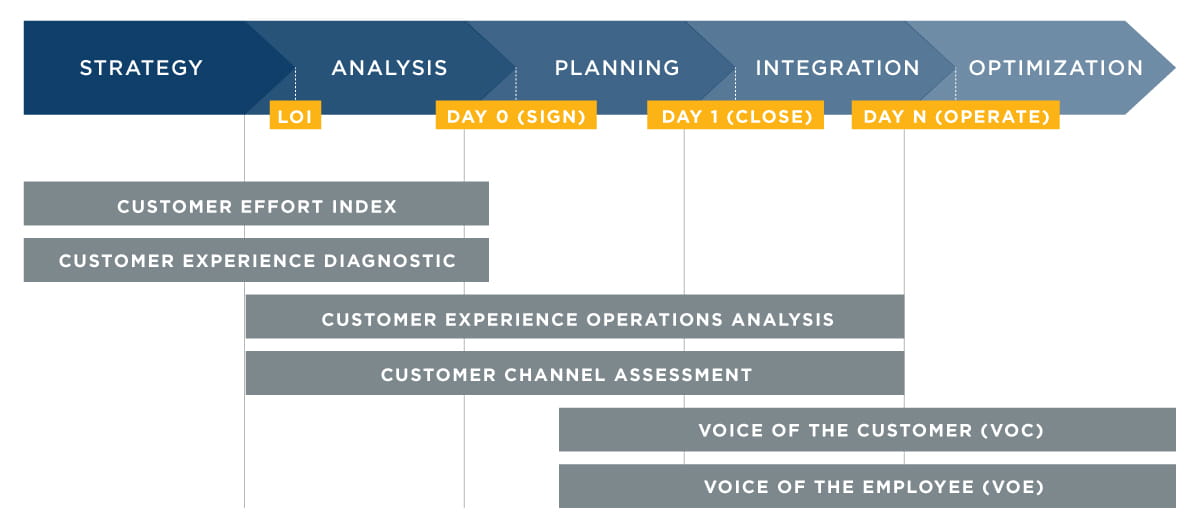

Waiting to think about customers and partners until integration is complete is too late. Instead, firms need to embed customer and partner experience into M&A playbooks at every stage: transaction strategy, analysis planning, integration, and optimization.

Strategy: Reinvent the experience.

A merger or acquisition is an opportunity for the two companies to re-imagine a future customer/partner experience. Use an external perspective to help define future opportunities, strategic objectives, and key performance indicators (KPI). This starts with seeing customer and partner experience at the center of a typical business model (target customer, value proposition, value delivery mechanism, and economic model– aka pricing). Rather than just focusing on the internal operational aspects of a business model through acquisitions, firms can take an alternative look at the two core acquisition strategies: leveraging an existing model and reinventing a new model. Firms with superior customer experience could leverage it as a permission platform to go into new markets (e.g., Uber or Amazon). Firms with a poor customer experience could use an acquisition as a way to reinvent that experience.

Tools to help diagnose customer effort and the overall experience provide insights into the strengths, weaknesses, opportunities, and threats that make customers want to continue doing business with a firm…or leave. They also provide the basis for evaluating the value of customer experience as an intangible asset of a company. A firm can easily build metrics like NPS or other customer experience perceptions directly into KPIs to ensure it doesn’t lose an external focus.

Analysis: Find the right customers…and assess your ability to serve them.

When customers are the primary value of an acquisition, then putting customers front and center of a firm’s business development activity is critical. First and foremost, this means understanding that customers are not monolithic. Rather, they have diverse reasons for doing business with and affinities to brands. For example, when Unilever considered acquiring Ben & Jerry’s, it needed to consider very carefully the environmental sustainability focus of the latter’s customers and determine if it could accommodate those needs operationally and culturally…or risk losing those customers.

Use customer and partner research to gauge the firm’s current customer experience, customer health and affinity to a target brand, and the risk of churn. Who are the customers and partners? What’s their health? Which are truly loyal versus which are trapped? What’s the flight risk? How do customer and partner experience improvements translate to loyalty to financial numbers? Tools like a customer viability assessment looks at target customers’ affinity to a brand and the risk of churn in event of a merger. Use social media monitoring to identify firms with a good reputation and word-of-mouth.

Assess the current operating model from the outside in, rather than the typical inside out. Customer operations and channel analysis using tools like customer experience blueprints map the actual experience to the internal people, processes, technology, and data associated with delivering it. These blueprints help firms assess the strengths, weaknesses and risks of key interaction scenarios like purchasing, onboarding, or getting support. They also shed light on the impact of cost savings assumptions that typically fail to look at customer expectations for service levels.

Planning: Make customers a cornerstone of integration planning.

When integration planning starts in earnest, put a customer experience person on the steering committee, governance team or in the integration management office (IMO) to review work output of other work streams. This person needs to make sure that the customer voice is at the table as the firm’s attention turns to employees, IT systems, and processes. Make sure this person is an unapologetically outspoken and respected customer advocate. It could be the chief customer officer or his/her proxy in firms with that role. Otherwise, identify someone with significant exposure to customers on the front line who can bring the external perspective into discussions.

Make customer experience an explicit work stream. The work stream should include mapping the customer experience, setting up customer feedback tools to identify integration priorities from the customer perspective, and embedding an “outside-in” perspective into other work streams.

Place customer experience metrics onto the integration scorecard. If internal measures of success focus solely on internal timeliness and cost savings, then customers will end up as an afterthought. To keep customers top of mind, make customer experience part of the scorecard that the integration team will use to measure its success.

Establish a mechanism to collect real-time customer, partner, and employee feedback data. It’s no good to receive data from scheduled surveys 60 to 90 days after problems and concerns arise. Instead, set up a mechanism such as an enterprise feedback management tool to collect and disseminate simple feedback to which integration teams and executives can respond as problems emerge. This keeps customers, partners, and employees assured as opposed to planning an escape.

Make customer experience the rallying point. To reduce the politics and employee anxiety during integration, use customer feedback data as a way to make decisions about integration priorities and decide between processes and technologies.

Integration: Communicate properly.

Firms need a communication plan that spells out the benefits for staying and the value that customers will receive from merger. For some mergers, months can pass between the letter of intent and the close of the deal, which spells a lot of potential to lose many customers as word gets out. Customer research can identify key anxiety points.

Use real-time customer, partner, and employee feedback data to proactively plan communications to ease anxiety across the board, as well as to set expectations for how and when the integration will happen and the firm will make fixes to problems that arise. Don’t wait for a fully functioning marketing

automation tool or other communications systems to be integrated—that will be too late. Establish a communications governance body comprised of representatives from both firms to coordinate messages. Use existing communications mechanisms and channels to reach customers.

Relieve employee and partner anxiety by making critical decisions early. Leadership needs to make create clarity around decisions that impact employees and partners and communicate those decisions. Otherwise firms will face attrition that can impact customer experience and financials.

Optimization: Report customer experience metrics to the financial community.

Little speaks louder about what’s important to a company than the metrics a firm reports to the financial community. That’s why firms like JetBlue, Phillips, Level 3, and Costco regularly share with financial stakeholders how they’re doing on customer experience.

Conclusion

Final thoughts: Don’t do it alone

Strategists and business development executives who ignore customers do so at their own risk. The loss of customers during- and post- transaction, the overlooked intangible asset of a good brand reputation, and the ability to achieve revenue objectives center on the attention firms pay to customers. While not the norm today, the good news is that leaders don’t have to shift focus on their own. Leaders should look to two sources of help to make sure the company keeps its eyes on the customer prize. First, identify and include individuals from existing internal customer experience teams. They provide an invaluable resource to shed light on what customers are thinking as well as to provide insights on what matters most to them. Second, most firms also hire external consultants to help with M&A activity. Look for a consultant that understands customer experience and has the credibility and tools to illuminate the customer perspective and adapt priorities that benefit both customer and company.