June 2021 | Point of View

Modern AMI for utilities: Approved or currently in deployment

Developing a roadmap that outlines AMI business case benefits will allow utilities to realize full value of their deployment

Modern AMI for utilities: Approved or currently in deployment

Many utilities across the country are just beginning or are on their way to deploying AMI. For utilities that already have successfully received regulatory approval to invest in AMI, the focus shifts to effectively executing a multi-year program that will impact all aspects of their business and customer base.

Depending on the level of planning completed in parallel with the filing and/or approvals processes, utilities may be starting from different points once AMI programs commence. Regardless of a utility’s starting point, there are core considerations and steps to effectively build a foundation for success and deliver the value outlined in any utility’s AMI business case.

Establish a program charter and governance plan

A well-defined program charter and governance plan serve as the cornerstone to any successful AMI program. Given the size, level of complexity, and broad impact of this investment, creating alignment within a utility’s executive stakeholders and program leadership is critical. All parties must understand and be bought into the mission of the program, including the specific value they seek to deliver through AMI. Without that unified direction at the leadership level, it’s impossible to create momentum for the many other contributors required to execute an AMI program.

In addition to creating alignment on program purpose and direction, establishing a program governance plan sets the framework for executing on key workstreams and milestones, identifying and working through interdependencies, and mitigating the impact of any risks or issues that inevitably arise.

This governance plan is more than just a detailed responsibility assignment (RACI) matrix and will look different from governance plans for other large utility programs. AMI programs involve a unique blend of field, IT, business, and customer-facing activities. The program governance plan must be reflective of the required level of cross-collaboration.

Once the charter and governance plans are in place, it’s important to leverage and maintain these cornerstone documents over the course of deployment. AMI programs will naturally involve frequent onboarding of new team members and stakeholders as new phases and milestones require specific skillsets within the long-term program execution. The contents and messaging of the program charter should be leveraged to set a baseline for any new team member and get them aligned to the program direction, and the program governance plan can be valuable in creating understanding for how one contributor or workstream fits within the broader program. Additionally, these documents should be reviewed regularly by program leadership to ensure program direction and governance are in alignment with these foundational assets.

Expand change management efforts

In a proactive deployment, initial change management, stakeholder engagement, and customer education activities will be underway, having kicked off in parallel with regulatory approval activities. Once the AMI program has been approved and is moving toward deployment, these activities expand significantly to prepare all program contributors, employee and executive stakeholders, and other external and customer stakeholders to utilize AMI effectively.

Customer communications and education and external stakeholder engagement are important in preparation for and throughout field deployment activities. Educating customers on the benefits of AMI, in addition to communicating clearly prior to actual AMI meter or module installation, goes a long way in mitigating the risk of customer refusal or complaints at the time of installation. Once AMI devices have been installed, follow up with customers to inform them of the ways they can leverage newly available interval usage data to improve customer experience and help increase customer self-service.

Engaging with key external stakeholder groups such as labor unions, community leaders, customer advocacy groups, and regulators as part of deployment planning will give those stakeholders a voice in the process and create smoother coordination among groups. Maintaining this dialogue with external stakeholders throughout the deployment is also key to keep them informed and in alignment with program objectives.

Internally, change management activities will also evolve as the program progresses from planning through deployment execution. Early on, employee workshops, listening sessions, and knowledge sharing sessions are effective for educating all program team members and utility employees on the value of AMI, and specifically the way AMI will impact their individual role. As the program progresses, change management efforts will be focused on designing job aids and training materials to equip end-users with the knowledge and tools they need to utilize the new technology and functionality delivered by AMI. Throughout all change management activities, cultivating a culture of change stems from program and business leaders serving as active change advocates. This culture shift is key to maximizing employee adoption and utilization of AMI.

Procure hardware, software, and program resources

Some utilities opt to select technology and service vendors prior to or in parallel with regulatory filing and decision-making. For utilities who choose to wait for regulatory approval before selecting vendors, the same processes and level of diligence are often required. This entails releasing competitive requests for proposals (RFPs) for all associated vendors (e.g., AMI network, installation vendor, meter data management system, customer portal, etc.).

Increasingly, grid edge computing using AMI endpoints, usage data disaggregation, and expanded network bandwidth are sought-after capabilities of the next generation of AMI deployments. For utilities just beginning vendor selection and procurement activities, it’s critical to understand the cost and benefit tradeoffs of sticking with more proven but basic functionality of first-generation AMI solutions, versus opting for the next generation of AMI technology. Regulatory environment and customer sentiment must also play a part in those considerations. Because the proposed benefits of the next generation of AMI largely hinge on the speed of distributed energy resource (DER) and electric vehicle (EV) penetration, some regulators and customers may prefer a utility begin by deploying more basic solutions and then deploy additional solutions down the road to unlock more advanced functionality.

In addition to building a perspective on the type of AMI solution that best fits a utility’s strategy, each RFP released should include service-level agreement (SLA) commitments, appended such that they transition directly to contract language. Further, the RFP should require a detailed propagation study that accounts for utility-owned assets, permitting requirements, and other considerations. If contracted installation labor is included in the RFP, utilities should consider proposing contractual mechanisms for the vendor to perform onsite repairs to reduce unnecessary truck rolls and hand-offs. Common SLAs for AMI system performance include:

Interval read success rate

Billing read success rate

Network redundancy

Network uptime

Network failure rate

Endpoint failure rate

Data link availability

Scheduled maintenance

On-demand reads

Throughout the planning and selection process, utilities and any professional services should remain completely vendor-agnostic until final bids have been proposed. This allows internal stakeholders to maintain an open mind and vendors to sharpen their pencils in pursuit of industry-leading pricing and warranties. Contractual commitments should be bound through any required approval processes (e.g., Commission, City Council) and used to update the business case based on received bids and the preferred vendor.

Once all vendors have been selected, procuring all necessary hardware and building a framework for managing and tracking inventory becomes a key focus for supply chain, program management, and field deployment workstreams. Utilities should isolate deployment-specific hardware to streamline inventory ownership and controls. Given that AMI meters and other hardware often involve global supply chains and purchase orders can be in the tens of thousands of units, it is crucial that utilities develop a flexible procurement plan to mitigate the risk of deployment delays. Particularly if the utility has separate system and installation contracts (versus a single network contract with subcontracted installation), work stoppages due to material inventory shortage may result in unbudgeted vendor fees.

Additionally, as utilities execute deployment, it’s important to have detailed insights into inventory of all meter types at various warehousing facilities being used for deployment in order to remain nimble as deployment activities progress throughout the service territory. Hardware burn rate should be identified and communicated on an ongoing basis. Utilities should keep an open line of communication with the hardware vendor to understand and anticipate timeline impacts (e.g., end of year delays).

Integrate AMI into the business

AMI is truly a transformative technology that will have a lasting impact across utility business and operations functions moving forward. Additionally, AMI programs require collaboration across various internal and contracted contributors. With that in mind, the value of effective process design and redesign, in coordination with comprehensive change management, cannot be overstated when it comes to executing an AMI program and integrating this technology into the business.

Early in an AMI program, program leaders must work with their counterparts across field, IT, and business stakeholder groups to identify and document which existing processes need to be updated or completely redesigned as AMI functionality becomes available. Many net new processes will need to be developed to document roles and responsibilities created as part of the AMI program.

Throughout these exercises, it’s critical to emphasize transparency and collaboration across all affected parties. Building a framework for tracking and iterating on processes impacted by AMI can increase awareness across groups as deployment progresses, software, and firmware upgrades become available, or additional functionality is developed, and processes inevitably need to be updated. Utility IT organizations often have fully dedicated resources managing IT-related process design. It’s important for AMI business integration teams and these dedicated IT resources to have a clear understanding from the start of the program on how they can work together on a shared objective.

Execute deployment with the future in mind

As is the case with any long-term transformational program, it can sometimes be challenging to see beyond the current phase or near-term objectives of an AMI program when focused on execution. That being said, AMI program leaders can implement certain processes and frameworks proactively to set the foundation for a successful deployment and earlier benefits realization.

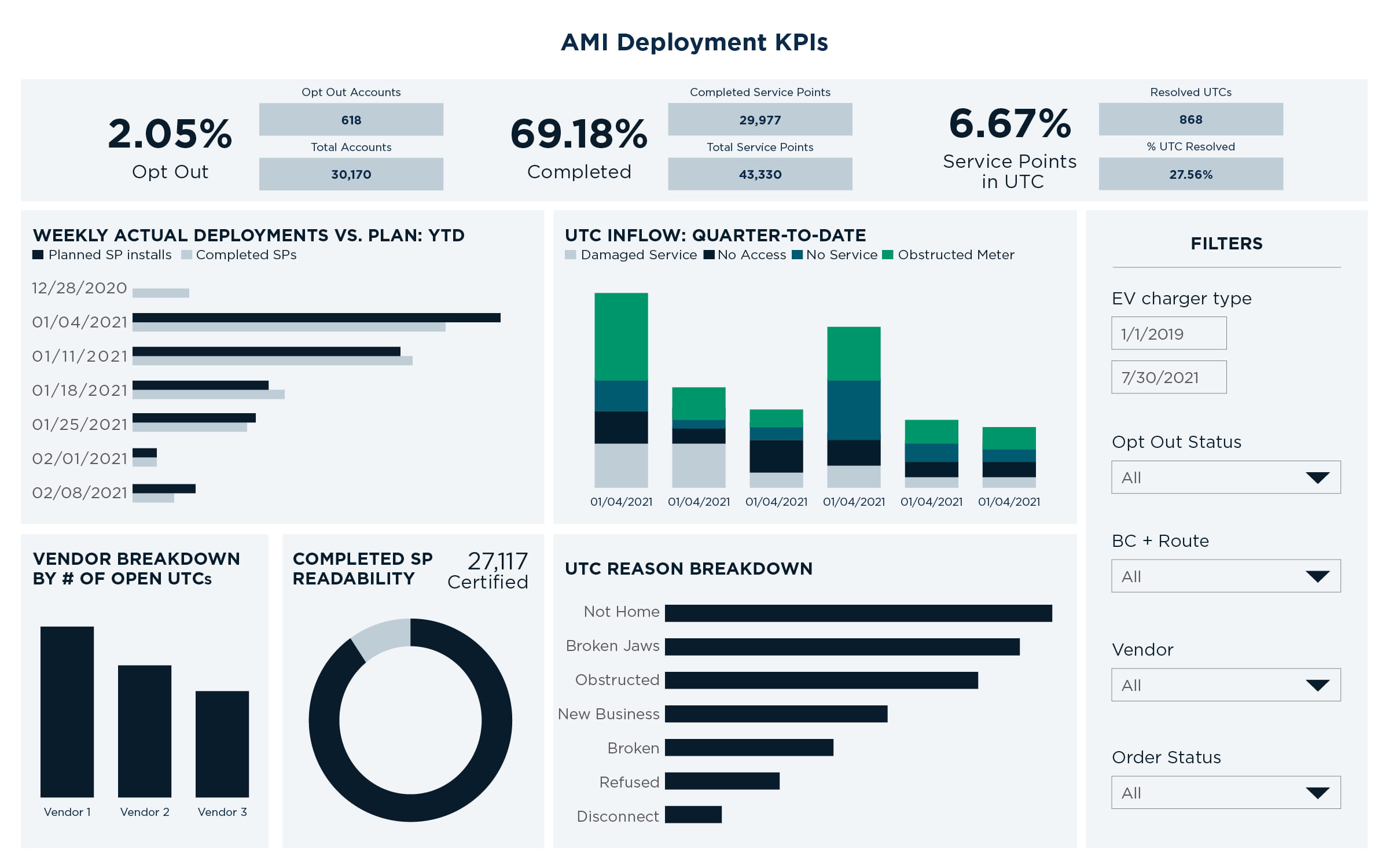

Utilities should establish key performance indicators (KPIs) that capture details on deployment status and progress. These KPIs will need to cover all facets of meter and network deployments, network health and operations, and end-stage meter reads and bill delivery. To make these metrics actionable, building a framework for tracking, reporting, and analyzing deployment and operational data in a centralized and accessible fashion is crucial. For deployment data, this means defining and implementing standards for how installers record and report installation progress, with clear details on installation status (number of attempts, additional maintenance required, unable to complete, etc.). Making deployment data digestible enables easier and more automated dashboarding, which proves extremely valuable as program teams look to intelligently prioritize work and inform leadership decisions impacting organizational budgets and strategy.

Defining a plan and associated processes for handling hard-to-complete or unable to complete installs will help alleviate headaches later in deployment. This can be effectively managed by establishing standard operating procedures (SOPs) for installation crews (whether internal or contracted) that define a clear flow from first installation attempt through any required maintenance work, customer opt out, or completed install. These SOPs should be developed prior to field mobilization to standardize and guide decisions in the field for a variety of standard and atypical installation scenarios (e.g., customer refusal, caved in pit, imminent failure, loose jaws, plumber/electrician escalations).

If not resolved or returned to the utility (RTU) regularly, field issues result in a final leg of deployment rife with a high concentration of challenging, potentially time-intensive escalations, a high degree of geographic dispersal, and a low degree of efficiency. Executing in line with those SOPs and leveraging detailed reporting to track these hard-to-complete installs as they are identified in the field will enable the program to resolve those installs that ultimately represent a very small percentage of the total deployment but require a significant amount of effort and resources per install.

Begin realizing and articulating benefits

In addition to deployment-focused metrics intended to inform program decision making and strategy, KPIs must be developed to monitor, report on, and drive benefits realization as deployment nears completion. Throughout the progression of AMI deployment, measuring the steady-state impact of AMI across field, billing, and customer care functions is critical to delivering on the benefits outlined in the program business case. Implementing these KPIs while still in deployment enables the utility to identify and articulate their progress against their business case objectives, course correct where needed, and ultimately start the clock earlier on delivering value from the transformational investment of AMI.

An unfortunately common criticism of AMI implementations over the last decade has been that these transformational programs have too often fallen short of their stated benefit targets. While a variety of factors contribute to this dilemma, a common theme is that utilities struggle to quantify AMI-enabled benefits that surpass the table stakes of streamlined billing and meter-to-cash benefits.

These more advanced benefits, such as smarter power outage detection, conservation voltage reduction, advanced rate design, district metered areas, or improved energy efficiency and demand response, may not have established benchmarks for benefit realization across the industry. Due to this lack of a reference point, utilities often don’t even know how to begin quantifying benefit targets or progress; however, that is no longer an excuse being accepted by regulators.

Utilities must develop a roadmap with input from external stakeholders that outlines the stated AMI business case benefits with specific milestones for realization. This roadmap can and should be iterative, as many of the advanced benefits are still being implemented and assessed, and collaboration with stakeholder groups and evaluation of new technology capabilities will be critical as utilities seek to deliver long-term value with AMI at the foundation.

.png?cx=0.5&cy=0.5&cw=910&ch=947&hash=88B19202A4DD005166ADD95D7B508137)