September 2017 | Point of View

Sell-side technology diligence in M&A: Can you afford not to?

Sell-side technology diligence in M&A: Can you afford not to?

With technology becoming a standard part of today’s transaction process, both financial and strategic buyers come to the negotiation table armed with insight about potential technology gaps and issues – insight they are using to negotiate discounts during the process.

Proactive sellers can counter this with diligence of their own. “Sell-side” technology diligence can shed light on particular areas of weakness and help a seller identify ways to mitigate those risks and their potential impact on deal value.

The earlier it occurs in the deal-preparation process, the greater the opportunities to preserve – or even enhance – transaction value. This article examines key short- and longer- term opportunities for using the insight gained through sell-side technology diligence, as well as additional implications when preparing a software company for sale.

Sell-side digital: What it is and why it matters

A decade ago, few buyers conducted formal technology diligence. Those that did usually relied on a limited, “check-the-box” exercise provided as an add-on service by a diligence partner that didn’t necessarily specialize in technology. In other words, such diligence didn’t produce much evidence to drive valuation discounts – and sellers experienced few “hits” to valuation at the time of sale based on factors related to the technology environment.

As technology has become more central to performance and competitive advantage, that approach isn’t effective. Today’s buyers spend time and money on formal technology diligence, the primary exception being smaller, add-on acquisitions where the value is in the customer base or product(s) being acquired or geographic expansion. As a result, many sellers today are feeling the pain of value erosion or discounts based on technology gaps or risks identified during diligence. Those include applications that are not supported or not scalable, outdated infrastructure, lack of security, compliance gaps, or insufficient disaster recovery capabilities.

Sellers have learned some lessons from an increased focus on technology diligence, and are getting smarter. Now, sellers are performing their own technology diligence to avoid a valuation hit down the road. This “sell-side” technology diligence can contribute both qualitative and quantitative value during the deal negotiation by surfacing issues and enabling the seller either to fix the issues prior to sale or, at the very least, to disclose them honestly to prospective buyers.

Think of it as preparing to sell a house. If the seller lists a house at $400,000 and is upfront with potential buyers about the leaky roof, the buyer may assume the seller has baked the expenditure of fixing the leak into the price. But if the house is listed at $400,000 and the buyer discovers the leak during the inspection, that buyer will likely ask for and receive a discount to fix the roof after close.

Addressing core technology issues can be time consuming. Therefore, the earlier a potential seller becomes aware of critical issues, the more opportunity the seller has to mitigate their impact on future deal value. West Monroe’s 2017 research with Mergermarket suggests that private equity investors begin sell-side deal preparations early in the holding period (see “Sell-side preparation starts early” on pg. 4) and that strategic sellers are also likely to be thinking ahead about maximizing deal value.

When is the best time for sell-side technology diligence?

Whether your deal is imminent or a couple of years fown the road, sell-side technology diligence can help you avoid value erosion.

Less than three months to sale

An imminent sale – less than three months – doesn’t allow much time to act on the findings of a sell-side technology diligence. Nevertheless, there are several ways you can use such insight to reduce the potential for value reduction.

- Focus on big issues and risks that require limited effort to remediate. While there aren’t likely to be many of these opportunities, they are ripe for the taking. A prime example is making sure your organization is compliant and up-to-date with software licenses. This is a topic that will almost certainly come up during the buyer’s diligence and can pose significant risk if not addressed. Other examples of issues that don’t require substantial effort to fix include insufficient data backup and/or fault tolerance/failover with key hardware. (Note that this is different than disaster recovery, which involves failover capabilities for the entire IT environment). A final example would be to remediate application performance or availability issues for mission-critical applications – those that play a key role in businesses operations.

- Establish a technology road map. While this might sound like it has limited value, the lack of a road map signals incompetence. Having a road map demonstrates that you understand gaps and issues. No potential buyer expects a perfect environment, but documenting your key initiatives for the next one to two years demonstrates competence and proactivity. Being upfront and organized in this way is far better than having a potential buyer uncover an “unidentified” issue for which there is no remediation plan – a scenario that is likely to result in a request for discount. For commercial software companies, having a product road map is simply required.

- Conduct performance testing. The buyer’s investment thesis will likely involve high growth. Therefore, it is important that key applications can scale sufficiently to support that growth – especially if your key systems are highly transaction-based or handle heavy loads. In the West Monroe/Mergermarket software survey, buyers rated scalability as the top concern when evaluating a software target’s potential technology issues. Take the time to perform stress testing on your one or two most critical applications, as this will produce quantitative data to support system scalability. Three months is plenty of time to conduct such testing, and there are outside services that can assist if internal resources are constrained. Most companies do not produce this data during diligence, making it an easy way to stand out and show maturity.

- Document your technology environment.Gather necessary documentation about your technology environment, including policies and procedures, compliance documentation, asset lists, capacity management plans, performance testing results, technology spend detail, and organizational charts. This accomplishes three things:

-

It helps avoid the mad scramble of trying to satisfy incoming requests during the heat of deal negotiations.

-

If done well and thoroughly, it will make the diligence process more efficient.

-

It provides a good first impression for potential buyers. Have you ever walked into an open house and found a messy home? If the seller hasn’t done the “little things,” then you wonder whether it has adequately handled the big risks.

-

- Bolster IT security. Two simple things can be done in less than three months to increase confidence regarding the security environment. First, and most important, perform a threat hunting exercise or compromise assessment. This entails running internal scans to determine the likelihood (with 98% confidence) you’ve been breached. It only takes a few weeks and the cost is reasonable. Second, perform a penetration test. While this isn’t as valuable as a threat hunt, it is quick, inexpensive, and will shed important light whether you may have large issues that would lead to a future breach.

18 to 36 months ahead of sale

If you are a couple of years away from selling, then you have a considerably longer runway for making changes – mitigating risks, removing scalability barriers, or taking out costs – that not only uphold deal value by avoiding discounts but also potentially increase enterprise value.

While every business, technology environment, and deal is different, there are certain opportunities to identify and address issues that buyers will scrutinize during their diligence.

- Fix compliance gaps. In many cases, buyers that identify compliance gaps – for example, payment card industry or HIPAA compliance gaps – require the seller to fix these and will delay closing until those fixes occur. It is far better to address compliance gaps prior to a sale than it is during that stressful time between sign and close – when you won’t have the time to issue formal requests for proposal, and will likely pay much more to service providers who see that you are desperate.

- Replace or upgrade key systems that are outdated, unsupported, or have performance issues. Whether it is an ERP system, a claims system, a CRM system, or a billing system, a core system with performance or other issues increases both business risk and capital cost. Some companies willingly forego the risk and push the project to the next buyer– which might very well be the right strategy based on other competing priorities. This will likely come with a cost that the buyer will inflate at closing – again, just like that house with the leaky roof. If you are confident in your team’s ability to execute, consider completing the project and owning the outcome prior to the deal.

- Get out of the custom applications business. If one of your key systems is custom developed and requires considerable internal support, ask yourself why you are still in the application development business. Consider migrating to a commercial software product and refocus your limited resources on other ways to be a better partner to the business.

- Bolster IT security. Security is a sensitive topic for all buyers. When you have enough time, make sure you have the proper investment in security tools and processes. You might also consider hiring a chief information security officer (CISO). If your business is too small to afford one, “rent” one from an organization that provides CISO services on an outsourced basis. Most diligences uncover several red flags in this area. You’ll be an exception if you’re able to remediate security issues and show a well- protected environment.

- Consider moving your data center to the cloud. Outsourcing commodity services such as infrastructure can pay dividends in today’s environment. If you still operate an on-premises data center and it’s old, consider migrating to a cloud-based data center environment. Do your homework to make sure you have the right protection regarding data ownership, as well as rock-solid service level agreements. Then, sit back and hold the experts accountable.

- Resolve data issues. As noted above (under short-term considerations), you will need to respond to an onslaught of diligence data and reporting requests. The earlier you can prepare for doing so, the better. One of the biggest issues in responding to such requests is bad data. Common data issues include decentralized data, integrity issues (e.g., accuracy or consistency), and/or limited data parameters. These “master data” issues can cause difficulties such as inability to drill down into details, provide a single view of customers or products, or calculate customer/ product profitability to make effective business decisions. Spend the next 18 to 36 months enhancing your master data management maturity.

When technology is the business

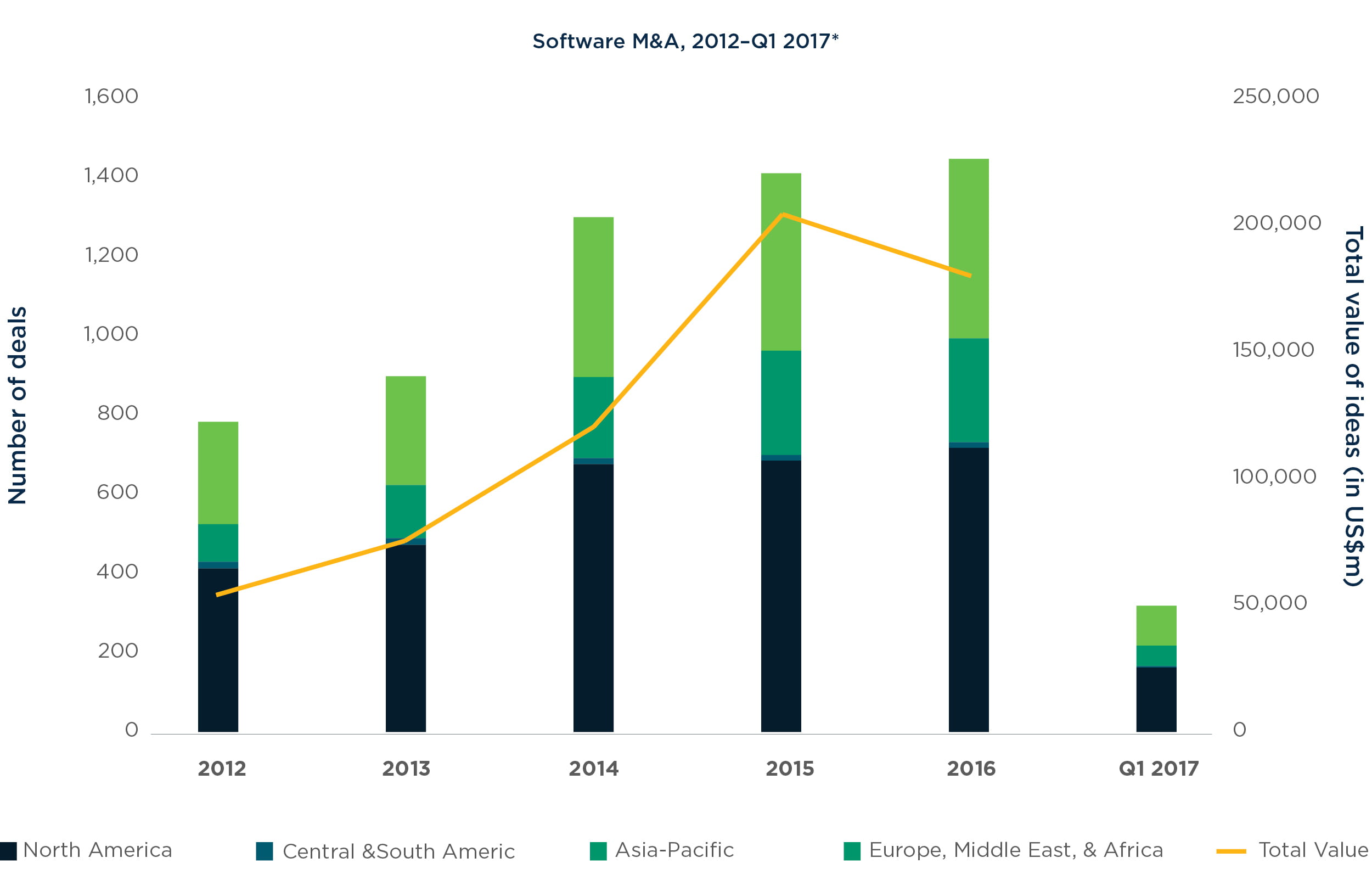

Deals for software companies or assets have become very popular as organizations across an array of industries look to leverage technology as a differentiator. In fact, 2016 was a blockbuster year for software mergers and acquisitions, with the highest number of such transactions – just over 1,400 – since Mergermarket began keeping such records 1999 (see below). Total deal value was close to 2015’s record high. Both private equity and strategic buyers are very active in this market, and the 2017 West Monroe survey with Mergermarket indicates that buying momentum will continue.

If you are planning to sell a technology company or assets, the steps you take to prepare for the sale will be even more critical – because the technology represents the value for the buyer. While all the points already outlined apply to technology sales, there are several additional areas that potential buyers will scrutinize.

Sell-side technology diligence can help you recognize and mitigate these areas of potential value erosion:

Reduce the number of technical platforms supported. If you have three or four different technical platforms supporting four or five products, then you are taxing the organization’s resources. Multiple technical platforms require a larger R&D team and higher maintenance costs. If you can consolidate, you should.

Decrease the size of your version footprint. If you still provide on-premises software, you are probably supporting multiple client versions. This drives higher operational costs, so you will want a documented plan to reduce your version footprint. This can be challenging because it also requires convincing your clients to upgrade. At the same time, if you don’t already have a software-as-a-service (SaaS) migration plan, begin putting one in place. With the exception of a few niche industries, on- premises software will be very limited five years from now.

Solidify your software development process. Your software development is your assembly line – but unlike a traditional product assembly line, it is more difficult to fix due to factors such as geographic dispersion of the process and team. Issues in the software development lifecycle (SDLC) lead to higher R&D costs and bad product releases and can hinder customer satisfaction. Many developers underestimate the work involved to address and fix SDLC issues. Depending on size, geographic separation, and number of platform technologies, improving the software development process can certainly take six to 18 months.

Reduce technical debt. Technical debt accrues when developers take shortcuts to fix a problem. Too much technical debt causes developers to spend excess time on maintenance and not enough on new development. Some technical debt is okay, but over time it can growth to levels as high as 30% to 40% of development time, for products that are not built or maintained well. You will need to quantify the estimated amount of technical debt in your environment and its corresponding drag on development. From this, you can define and pursue steps for addressing technical debt in advance of a deal – when you can expect sophisticated buyers to really scrutinize this area.

Strengthen product management. Your product management function is like an orchestra conductor. Without a well-run product management function, all other key functions operate less efficiently. One area to focus on: Make sure the product management function has or is creating a product road map with market, functional, and technical inputs.

Think ahead – and benefit

Timely sell-side technology diligence provides insight for shoring up weaknesses that could erode value at the time of a deal. As with many things, the earlier you start, the greater to potentially affect deal value – and the greater your opportunity to benefit in the interim.