October 2018 | Point of View

The next generation of health technology spending: Becoming a digital health system

Becoming a digital health system is a challenging endeavor and not possible for everyone, but transforming to value-based care is fundamental to the industry

Introduction

This paper is the final installment of a three-part series called The Next Generation of Health IT Spend. The series summarizes the recent history of health technology spend and predicts a new wave of needed IT investment. Learn more about this new wave of IT investment, and investment profiles health systems of the future.

Turning the corner on digital

In The Next Generation of Health IT Spend, we summarized recent history of health system technology spend, characterized by two mass scrambles to implement EHRs and meet new regulatory reimbursement requirements. It is our opinion that we are on the brink of a third mass scramble, this one potentially more extreme and more industry-altering than the others before it.

With a focus on population health, cloud strategies, robust analytics, and digital health, this third mass scramble is set up to fundamentally change the way health systems operate. The industry as a whole is poised for transformation due to the rise of consumerism, and health systems need to carefully plan investments to master the transition.

Chapter 1: Digital health is disrupting the industry

Digital transformation will drive the highest rates of technology investments in 10 years, according to Gartner, with $3.7 trillion spent in 2018 across all industries. Much of the current healthcare ecosystem, from health plans, to pharmacy systems, to health systems, are bracing for digital disruption as companies like Amazon, Berkshire Hathaway, and JP Morgan Chase enter the playing field. Value-based care and eliminating waste are just the beginning to reach the desired future care model. Once claims payout costs are controlled, an industrywide, fundamental transformation of the care delivery supply side will quickly be underway.

The patient of the future is already emerging. Three-quarters of patients state technology has the potential to improve their health and 61% report that the availability of digital services play an important role when choosing a physician. When patients are not completely satisfied with their health system, 91% look for other options and 88% are likely to switch providers.

These statistics are even higher for millennials, who are soon (within 10 years) to become the primary consumers of healthcare services. There was a time when patients were more attached and loyal to their doctors and local systems, however, the patient of the future will be more attached to on-demand, transnational care.

With mobile, personalized, on-demand services increasingly becoming the standard, consumer experiences from beyond healthcare are rapidly reshaping how patients expect to receive care. Information sharing has been a persistent challenge, but the democratization of healthcare data is already underway with a myriad of mobile and wearable devices that, unlike simply counting steps, can actually detect metabolic markers and predict personalized health outcomes faster and with more precision than 30- or 60-day claims.

The evidence is mounting: The digital health age has arrived and only the digitally strong will survive.

Chapter 2: The vision: What a digital health system looks like

Health systems realize that the future of care delivery not only encompasses clinical care but the entire patient experience. To become a digital health system, the ability to predictably create experiences that adhere to quality and generate desired financial, clinical, and experiential outcomes is essential. In fact, we posit that “experiential capabilities” are necessary to transform the people- process- technology equation, and perhaps most importantly, the culture of hospitals into digital health systems.

To become a digital health system, the patient and provider experience must be altered and supported via intuitive and automated technology. The experience needs to be three things: accessible, integrated, and data-driven.

Pillar 1: Accessible experience

Being accessible is more than having a certain number of clinics to serve a patient population or being open after business hours.

Accessibility today means new digital self-service solutions, mobile patient and provider portals, conversational interfaces like Amazon Alexa, online open scheduling, provider messaging, telemedicine, automated reminders and suggested scheduling, honoring patient communication preferences, real-time test results, and more.

Here are some projected digital healthcare experience trends that help paint a picture of what “access” will mean in the near future:

- By 2019, it is expected that 38% of appointments will be self- scheduled and 64% of patients will use self-scheduling

- West Monroe research shows that online/mobile scheduling today is highly underutilized and only constitutes 1.5 to 2.5% of total scheduled visits.

- 41% of patients say that providers can improve satisfaction by making it easier to schedule appointments

- 2/3 of patients would switch providers for access to medical records online; 33% would like to view their test results and diagnosis online

- 62% of patients want to communicate with providers by email

- Using online scheduling and improving online presence can bring in 20% more new patients

Smart, omni-channel communication capabilities are necessary to be viewed as an accessible provider. Training and education is necessary to drive use, but a strong technical foundation designed in collaboration with end users is critical.

At the end of the day, it’s about having options that the patient finds most convenient. For example, a patient may want (and expect) to pay online, in person, or by check. An example of this disconnect is 77% of providers use paper-based billing methods while 52% of patients prefer to receive their bill electronically and 68% would prefer to pay their bill online. Another example: A patient may want to see their PCP during weekends but do diagnostic imaging near their workplace during weekdays.

Pillar 2: Integrated Experience

An integrated experience connects a network of provider- and patient-centric processes, devices, systems, and people across geographies and departments. Mastering the art of delivering focused and relevant information to the caregiver at the right time is essential to build a digital patient and provider experience. This level of integration can empower engagement with patients and activate them in each step of their care plan—aligning scheduling to patient preferences, providing personalized health management tools and programs to patients—ultimately fueling integrated care delivery.

Integration goes well beyond primary and specialty care, inpatient and outpatient, supply chain, and clinical interventions. A truly integrated system will connect primary care, condition-specific specialty care, the patient, and their support system to drive high- quality, personalized care. This level of integration can only be achieved by facilitating secure, digital interactions.

Pillar 3: Data-Driven Experience

We commonly think of data-driven organizations as those that equip users with the right data at the right time. But being data- driven goes beyond information delivery and suggests actions aligned to an ideal patient and provider experience across entire care plans, from supply chain to caregivers to patients and patients support networks. Over 50% of hospital CFOs want access to easier report creation, better dashboards, and enhanced ability to drill down.

In our experience, the vast majority of reports remain unused or underused in a health system. Data-driven transformation that suggests specific, evidence-based courses of action is perhaps the most difficult pillar to achieve—especially given that this level of data sophistication requires capabilities that do not exist today:

Data augmentation: Augmenting administrative and clinical data with consumer data is key to creating meaningful, engaged, and outcome-oriented experiences through patient and provider interactions. While this is an embedded concept in other industries it has not made its way to healthcare.

Self-service reporting: End users in every department will request access to data, often overwhelming even the most efficient data teams. That’s why it is crucial to enable self-service tools for an organization’s common needs. A data team, however, should not be limited to simply building reports. They should be a strategic partner in understanding what data is available and what can be done with that data.

Data governance: A strong governance model that views data as a core asset of the organization is necessary, and it should be tailored to the organizational culture with centralized models instead of fully federated models.

Aggregation: Hospital CFOs struggle with pooling data from multiple resources. This less understood and often overlooked capability is key in converting data to value for a health system.

A defined process clearly documenting best practices for data acquisition, ingestion, cleansing, and aggregation is required to reap the benefits of volumes of data available to health systems.

Chapter 3: Regrounding in the road to digital health

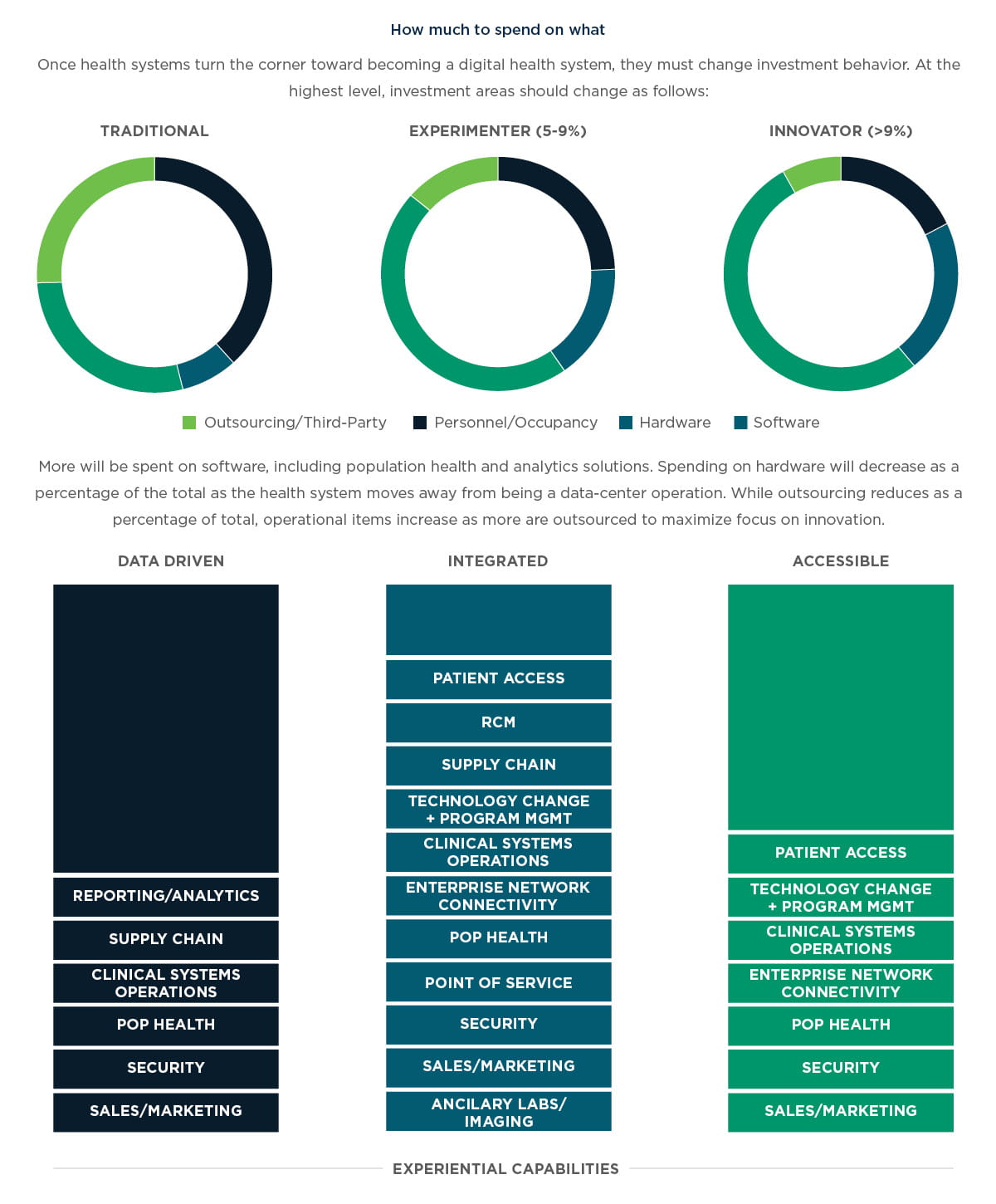

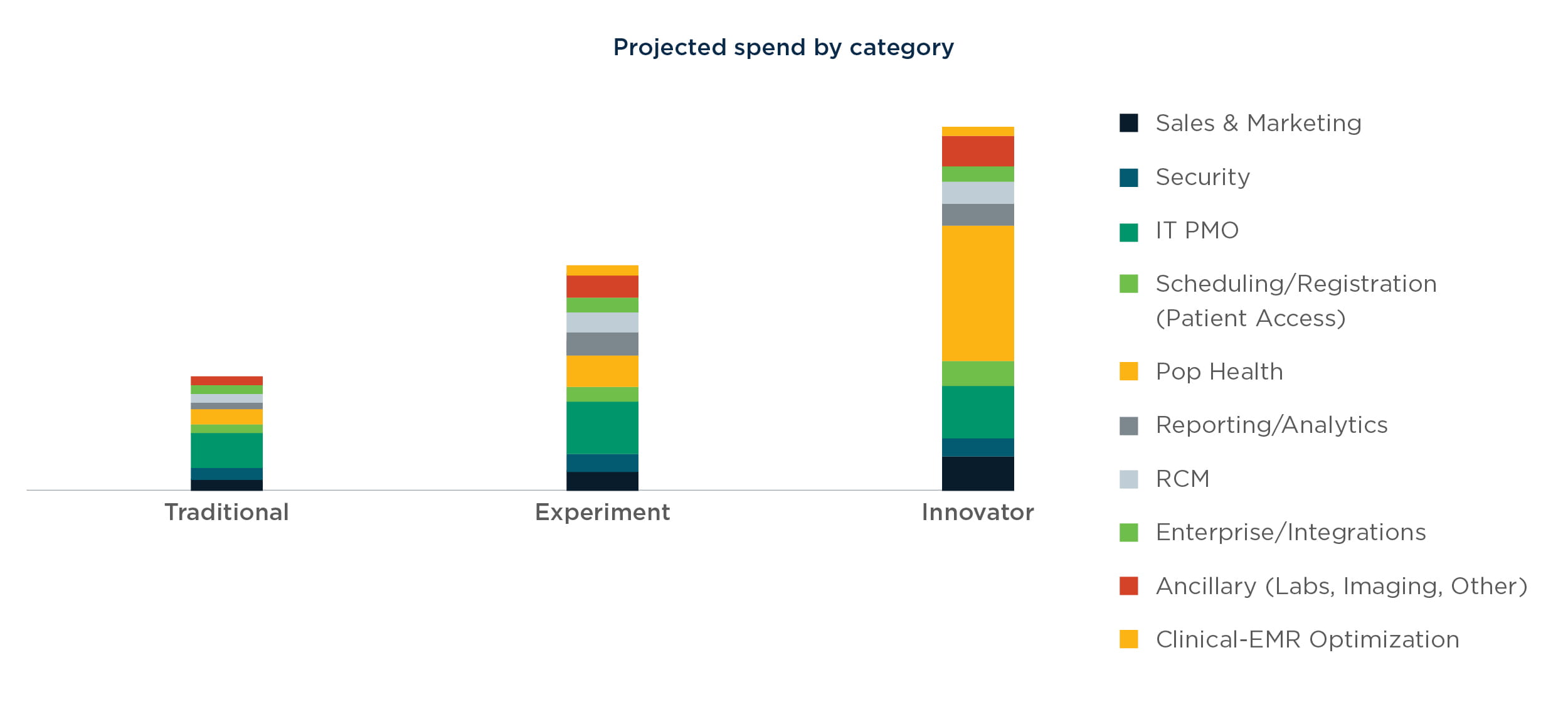

In the first part of this series, The Next Generation of Health IT Spend, we identified three investment profiles that will characterize health systems of the future. In our view, health systems will ultimately fall into one of three categories: traditional, experimenter, and innovator. Keeping these profiles in mind, health systems will transform into digital organizations in the following phases:

1. Turn the corner: When it comes to digital, this simply means to become an innovator along the IT spend maturity model. Innovators, according to our maturity model, will see technology shift from being a traditional cost center to a revenue generator.

2. Deepen the foundation: In our experience, several health system technology organizations are dabbling in revenue and margin contribution. However, this is not yet a sustainable or scalable proposition. Health systems must solidify their technology foundation by deepening experiential capabilities and investing in areas that enable the experiential pillars.

3. Merge margin and mission with predictability: With a deeper foundation in place, technology stops being viewed as a tactic with sporadic results. Rather, technology becomes a high-margin contributor to the bottom line with keen regard for the mission of the health system leading to greater predictability.

Chapter 4: How to turn the corner on digital

To successfully move into the digital realm, health systems must invest in the following areas. As the health system deepens its technology foundation, it can evolve based on regional market dynamics for patients, clinical caregivers, and payers.

Reporting/analytics: Health systems have access to volumes of valuable data (clinical and administrative) and increasingly have access to consumer and wearables data that can be used to develop personalized and engaging health management programs for patients. This is the most challenging transformational area of investment for health systems as it requires them to become a different type of organization. Most systems have yet to develop a centralized, coherent, and dynamic governance and technical architecture necessary for retrospective and predictive analytics. Most predictive analytics are still based on claims data that is 30 to 60 days old. That’s a good starting point, but it’s but certainly not the leading edge of what is possible. Health systems possess so much data they are often unsure where to start, and analytics often becomes an initiative led by IT with poorly defined success parameters. This leads to a reactive organization that creates lots of reports but rarely takes action. Health systems must not only incorporate analytics as part of the clinical point of service but ultimately become driven by analytics and use insights to create financial and clinical value across the lifecycle of care and the ecosystem of patients, providers, communities and employer groups.

Patient access: With the gap between supply and demand for care increasing, access to the right mode of care (physician, nurse, medical assistant, self-service, or artificial intelligence) remains an unsolved problem. Additionally, access centers will use customer and physician relationship management systems to optimize patient and provider experience. Currently, most health systems are reactively working toward incrementally enhancing their access centers. In our view, the access center must be seen as a digital asset that will be leveraged in the future to enable-value based care with strong financial and clinical outcomes.

Revenue cycle management (RCM): The vast majority of health system revenue today is still based on fee-for- service models and thus RCM remains a key method to “finance” all the digital transformation needed for the current and future state. When digitally enabled, proper codification of services will enable better analytics from a clinical and value-based care perspective as systems start to transition to risk-based contracts. Additionally, fewer errors will result in lower denial rates and more rapid fee collection from payers.

Supply chain: Most health systems can identify inconsistencies, redundancies, and waste in the supply chain and inventory-management process. While enterprise resource planning systems have matured a great deal for the consumer industrial products industry, the ERP wave remains quite immature for health systems. A digitally integrated supply chain would deliver appropriate inventory stock of key drugs or supplies to meet timely demands while preventing overstocking, thus optimizing the inventory cost and reducing overall operations costs.

Clinical systems optimization: For most EMR implementations, the initial versions are complete, but still require optimization. Most health systems met EMR deadlines by rushing implementations and meeting minimal product requirements leaving enhancements to be pursued at a later date. EMR optimizations are still a critical need in order to enhance provider availability, workflow optimization of care management processes, and the standardization of order sets.

Enterprise network connectivity: System-to-system data and workflow integration of EMR data, care management systems, and ERP financial data is a critical component of value-based care that remains undeveloped. For example, strong, live integration between the inventory system and EMR system is often lacking causing stock outs or overstocking, not to mention drops in service level during the point of care.

Population health: Health systems must invest in population health solutions to move to value-based care. But they must also more successfully manage patients to contain cost, improve outcomes, improve patient experience, and improve provider experience.

Point of service: With rising consumerism and more financial responsibility falling to the patient, engaging the patient financially at the point of care is critical. Mobile and kiosk solutions that allow self-check in, payment, and payment planning will become the norm for digital health systems.

Cybersecurity: Security is usually thought of as something only technical and defensive. However, for digital health systems, a holistic security model not only prevents reputational damage but engenders trust among the customers from which a deeper relationship can be formed.

Sales and marketing: For most health systems, billboards and media remain one of the key ways to market in their communities. However, the digital health system of the future will invest intelligently in augmented consumer data, targeted media, and digital advertising to attract and retain patients and providers. Furthermore, a deeper and more meaningful closed-loop feedback system must be created that reveals patient behavior.

Ancillary/labs/imaging/retail: For many ancillary services, healthcare remains a predominantly retail experience when it comes to labs, imaging, select dermatology services, dentistry and optometry. Margins for such businesses are attractive enough that health systems cannot ignore them—but they should be embraced to subsidize the core clinical operations that are often low margin. Infrastructural investments in technology to enable connectivity and digital communication becomes a necessity.

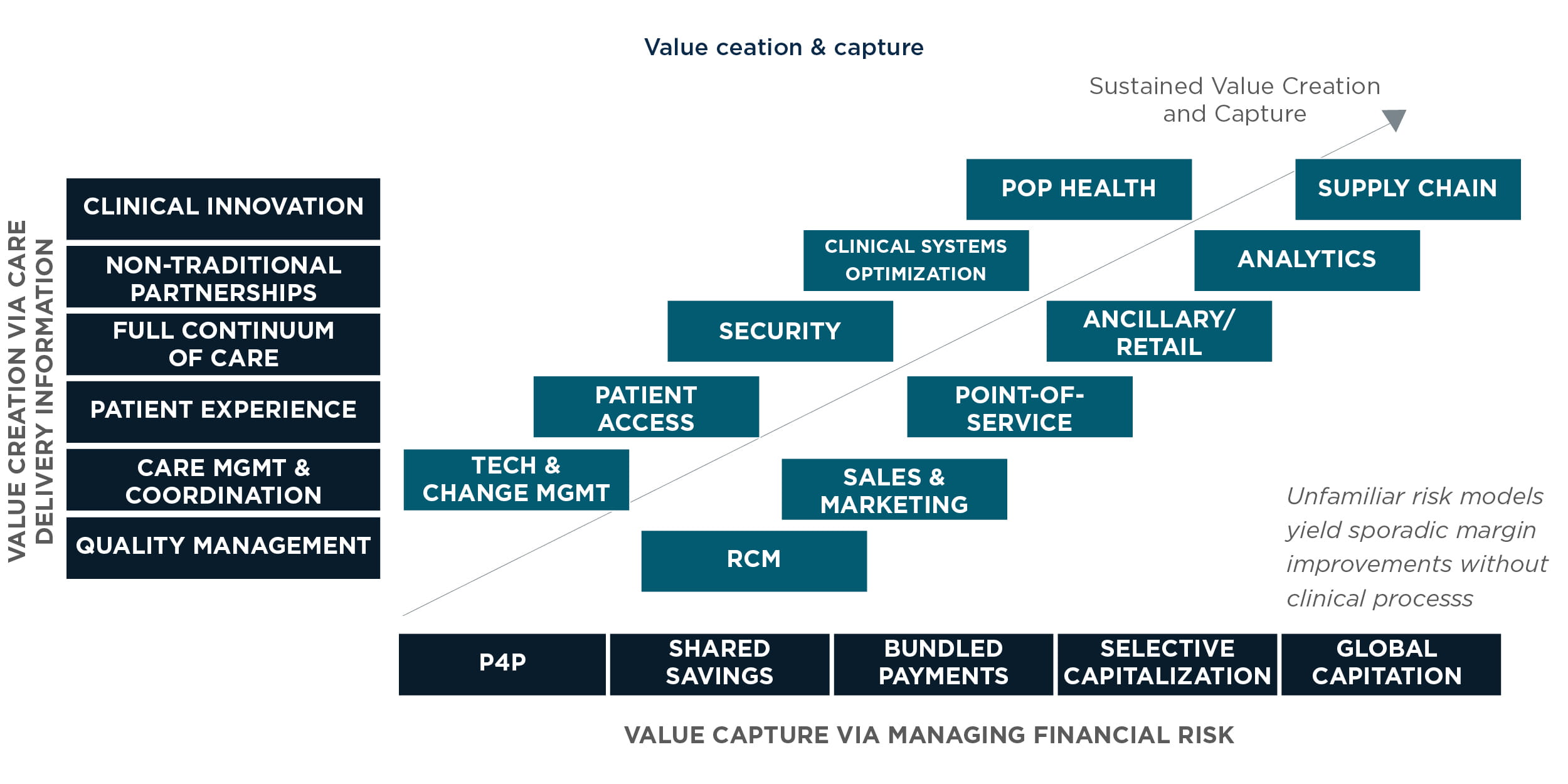

Chapter 5: What value can health systems create and what value can they capture?

Often, doing something for clinical purposes may be perceived as creating value for the patient but ultimately conflicts with the health system’s financial goals. In other words, investment in digital can create value for a larger group of “users”—patients, providers, families, and the community—with undefined value for the systems itself.

When turning the corner on digital, benefit realization must be defined to ensure that sufficient value is created for the broader ecosystem, while ensuring that a defined path exists to ensure system sustainability. Below is one example of how a health system may choose to balance value creation for others with value capture for the system.

Typically, a strong foundation must be established for the technology organization via a strong program management and change management office. This creates value for internal customers, providers, clinical staff, and administrators. Next, patient access revenue cycle management becomes a way to solidify returns from the fee-for-service business.

Then, we turn to security, an overlooked investment area—until a sizable breach occurs and shakes the confidence of the patient and community. The area that comes next is sales and marketing, where augmented consumer data and CRM solutions improve the relationship with patients and providers. Most systems have an EMR in place and may be consolidating systems through acquisitions, thus consolidation and optimization of the clinical workflow system will remain an initiative for the foreseeable future.

Next is point of service, which provides a customized and personalized retail feel in which checking into the clinic or hospital is similar to checking into an airline flight (e.g., self-check in). Population health is an area that health systems cannot ignore, it protects the margin erosion and revenue threat from a value-based payment model. Ancillary systems and retail healthcare is on the rise and often represent high- margin lines of service as well as growing revenue via ophthalmology, dermatology, and even dental providers.

Analytics become an insight provider and value-capture capability by making better purchase decisions, coding Medicare Advantage Risk Adjustment to enhance revenue, and optimizing utilization of services across fee-for-service and capitated contracts/bundled payments to drive higher margin—not always higher revenue. We place supply chain last, because the first step in value-based care is reducing cost for claims payouts. Most systems aim to achieve lower cost per patient as a means to lower revenue via utilization management and better care coordination. But there is hardly any focus on consolidating contracts and managing inventory and supply to make back-end costs more efficient, thereby dropping cost and improving margin from capitated contracts. We see this as a longer-term value regarding the realization of benefits.

Chapter 6: What must health systems change to become digital?

Becoming an innovator is simply the beginning. Getting there is like crossing the chasm, representing the most difficult part of the journey. This is because the foundational culture and DNA of a health system must change.

Beyond care delivery, health systems become an insights-driven analytics business. Historically, analytics played a very small role in the capabilities and spend for health systems. Not only must health systems be like a risk-bearing insurance firm, but one that predicts clinical, financial, and consumer behavior as a means to optimize financial and clinical outcomes.

Health systems are the central hub connecting many players. Enterprise data and systems integration becomes a core competency of the health system. This means investing in the correct connectivity technologies, developing the right people who have a systems/data integration mentality, and changing the culture to one that connects systems with a specific purpose in mind.

Managing a population like a portfolio of risk products. Population health has become quite a buzzword for health systems and it’s one that must be grounded in real, actionable work to optimize utilization, match patients with the best providers, control for complex and multiple conditions, and do so as a portfolio of risk rather than a narrow and siloed group on a disease registry. This of course builds on analytics capabilities but includes clinical process to be pragmatic and scalable.

Patient access isn’t a “nice to have.” It accelerates the journey to value-based care. Creating efficient scheduling, registration, and improving financial performance becomes a foundation for the journey to value-based care. From our perspective, access centers serve as a digital asset to be developed, one that brings together user ease with technology. If developed with a certain maturity vision in mind, access centers can yield returns in a FFS model and ultimately become a means to population health, thus accelerating the health system’s journey to value-based care.

Security isn’t just about reducing risk. It’s a strategic pillar for consumer trust. By definition, a digital enterprise has the digital trust of its users, whether they be patients, physicians, clinicians, administrators or patients’ family/friends. There is much catch-up work for health systems to do to improve security and gain consumer trust.

Conclusion

Becoming a digital health system is a challenging endeavor, and not possible for all health systems. However, it is our view that transforming to value-based care is fundamental to the industry whereby health systems will have to become risk-bearing and risk- managing entities. As such, only digital health systems will survive and thrive. Careful thought, consideration, and an aligned leadership commitment are prerequisites to the transformational journey to digital health.

Financing such a transformation is a key challenge. Because there is no standard formula, each health system must evaluate its current portfolio of business lines and tailor a path where certain revenue streams, like inpatient fee for service revenue lines, are thoughtfully and sustainably replaced by risk-bearing revenue lines. It is a journey unique to each system.