Digital and Org Design: 4 Insights from Financial Services Leaders

Key areas of opportunity across people, process, and technology at the start of 2023

Financial services companies have compelling visions for a digital-first future—making strides to create digitally agile organizations. But they can still make progress in aligning with customer priorities and embedding a digital mindset throughout their organization.

West Monroe’s recent signature research reports, Be Digital and Building a Digital Organization, highlighted how consumers and leaders are embracing digital—and how that helps organizations streamline processes and double down on areas with the greatest value. West Monroe’s data highlighted four key areas of opportunity for financial services firms.

Digital and Org Design: 4 Insights from Financial Services Leaders

Insight 1: Financial services companies say they’re increasingly driven by customer demands—but customers don’t see it that way

In keeping with their focus on customer experience, financial services companies report that expected customer need is their top driver of product development. However, only 65% of customers feel that their bank effectively anticipates their needs—suggesting that banks and credit card companies have room to improve.

Just about half (52%) of financial services companies report that customer centricity is embedded in their culture, strategy and processes, and guides everything they do.

- 71% say their organization invests heavily in customer experience when developing products

- 44% rank “improved customer experience” as one of their top three priorities for growth in the next three years

While organizations feel they’re product- and customer-focused, the internal culture needs to support testing and learning to be even more adaptable to product enhancements and customer demands.

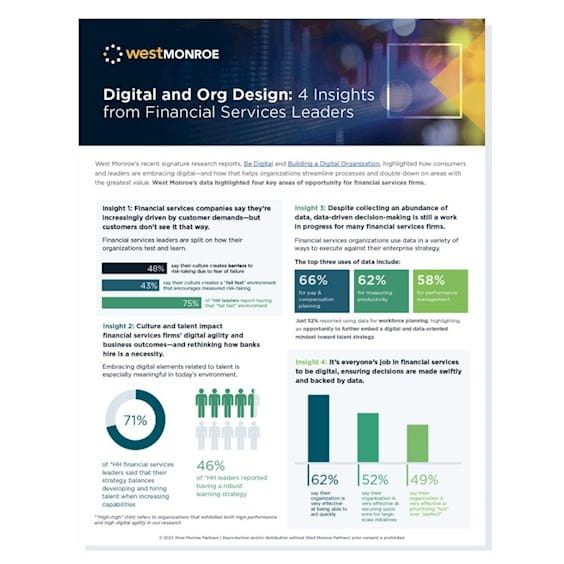

Financial services leaders are split on how their organizations test and learn.

- 48% say their culture creates barriers to risk-taking due to fear of failure 43% say their culture creates a “fail fast” environment that encourages measured risk-taking

- 75% of HH leaders report having that “fail fast” environment

Action: Instill the customer in everything you do—and foster a culture that allows employees to “fail fast,” prioritizing customer experience in innovative ways without fear of punishment.

Insight 2: Culture and talent impact financial services firms’ digital agility and business outcomes–and rethinking how banks hire is a necessity

High-performing, digitally mature organizations bring together diverse perspectives to problem-solve, develop new solutions, and make improvements iteratively. A notable 90% of these organizations report proactively measuring, rewarding, and recognizing employees for working collaboratively to achieve business results.

But about half (57%) of financial services and banking respondents said their organizational conditions support agile workflows, cross-team collaboration, and decentralized decision-making. Balancing the right retention and attraction of talent—combined with room for learning and upskilling—can help drive a company’s digital efforts across the enterprise.

Embracing digital elements related to talent is especially meaningful in today’s environment.

-

71% of high-performing financial services leaders said that their strategy balances developing and hiring talent when increasing capabilities

-

46% of high-performing leaders reported having a robust learning strategy

The profile of a bank employee is changing. As banks compete with fintechs and chart their own digital course, banks are looking increasingly like technology companies—yet many banks are still prioritizing legacy skill sets. Banks must be able to leverage the technology in which they’re investing to gain insight into operations. If done properly, this becomes a scalable digital foundation that empowers human capital more effectively and facilitates both growth and an increasingly digital approach.

Action: Review culture, talent, and organizational structure, considering how easily employees can collaborate, make decisions, and move projects forward. Banks also need to think differently about the skills they hire. Start to proactively recruit for digitally forward skillsets like data engineers or those with experience in AI/ML.

Insight 3: Despite collecting an abundance of data, data-driven decision-making is still a work in progress for many financial services firms

Banks and credit card companies recognize the importance of maximizing their use of data and technology—and most report that they’re making progress on this front. But there’s more progress to be made: Just 44% of leaders gave themselves an “A” grade when asked about the maturity of their access to and use of data. A notable majority (81%) said they have an integrated tech stack, and “customer data/insights” was the most common prioritization for respondents’ next big digital investment.

There is still a curve for getting up to speed and fully embracing data for decision-making, but banks and credit card companies generally believe they’re using data effectively: 93% say their organization is effective at building secure, flexible data platforms, and 96% report taking a responsive, data-backed approach to problem solving. However, only half use data to guide everyday decision-making or say they use data to speed up decision-making across the organization on an ongoing basis.

Financial services organizations use data in a variety of ways to execute against their enterprise strategy.

-

The top three uses include: 66% for pay & compensation planning, 62% for measuring productivity, 58% for performance management

-

Just 52% reported using data for workforce planning, highlighting an opportunity to further embed a digital and data-oriented mindset toward talent strategy.

Action: Evaluate how your organization collects and stores data and how it can be better used to drive decisions.

Insight 4: It’s everyone’s job in financial services to be digital, ensuring decisions are made swiftly and backed by data

Digital can’t be the purview of a single individual or department–it must be a universal mindset across the organization, embedded in every function and championed by every leader. Thriving digital businesses work in agile, multidisciplinary, product-oriented teams to design and build integrated experiences around their customers’ needs.

Fortunately, more than 90% of financial services providers report that their organization effectively activates and uses interdisciplinary teams. Half of financial services and banking leaders either “agree” or “strongly agree” that their organizations can sense, analyze, and quickly respond to changing conditions using secure technologies, platforms, and a formalized data strategy. These responses were from HH organizations, demonstrating how being nimble and able to leverage digital tools can drive business outcomes.

Companies with a digital mindset prioritize quick wins and drive change by taking swift action. For many legacy businesses, this also entails a mindset shift because banks and credit card companies have not always had a reputation for adapting quickly to change.

Financial Services companies are rising to the challenge, but only about half are fully confident in their ability to secure quick wins for big initiatives.

-

62% say their organization is very effective at being able to act quickly…

-

…but fewer (52%) say their organization is very effective at securing quick wins for large-scale initiatives…

-

…and only 49% say their organization is very effective at prioritizing “fast” over “perfect.”

By embedding a data-oriented, digital mindset into an organization’s culture and overall strategy, financial services companies will be better equipped to evolve and meet customer and market demands.

Action: Clearly articulate each leader and area of the company’s role in embracing digital, with tactical benchmarks for progress to better facilitate cross-organizational buy-in.

Conclusion

West Monroe’s research finds that when it comes to the customer-centric component of a digital mindset, financial services firms tend to be ahead of the curve, but in need of doubling-down on the customer-centric mindset. Executives in the industry know that the heart of being digital is accountability, leveraging data to inform decision-making, and ultimately, embracing a digital mindset.

To get ahead in 2023, financial services organizations can identify the most profitable customer segments, cater to customer needs, and increase “stickiness” to prevent potential deposit runoff and navigate economic uncertainty. By failing fast—working in an iterative way—and creating the mindset shift to operate in conjunction with data and digital solutions, organizations can more impactfully continue their digital journeys.