November 2019 | Report

Quantifying the ROI of Customer Experience

A poll of practitioners weigh in on their ability to demonstrate the ROI of CX

Quantifying the ROI of Customer Experience

Regardless of industry, organizations broadly recognize that customer experience must be a top priority. Companies have responded by pursuing a range of efforts to raise their game, from adopting digital technologies and becoming a customer-centric organization to integrating new engagement approaches. A byproduct of these additional investments is the increased pressure on customer experience leaders to communicate the bottom-line benefits of their initiatives.

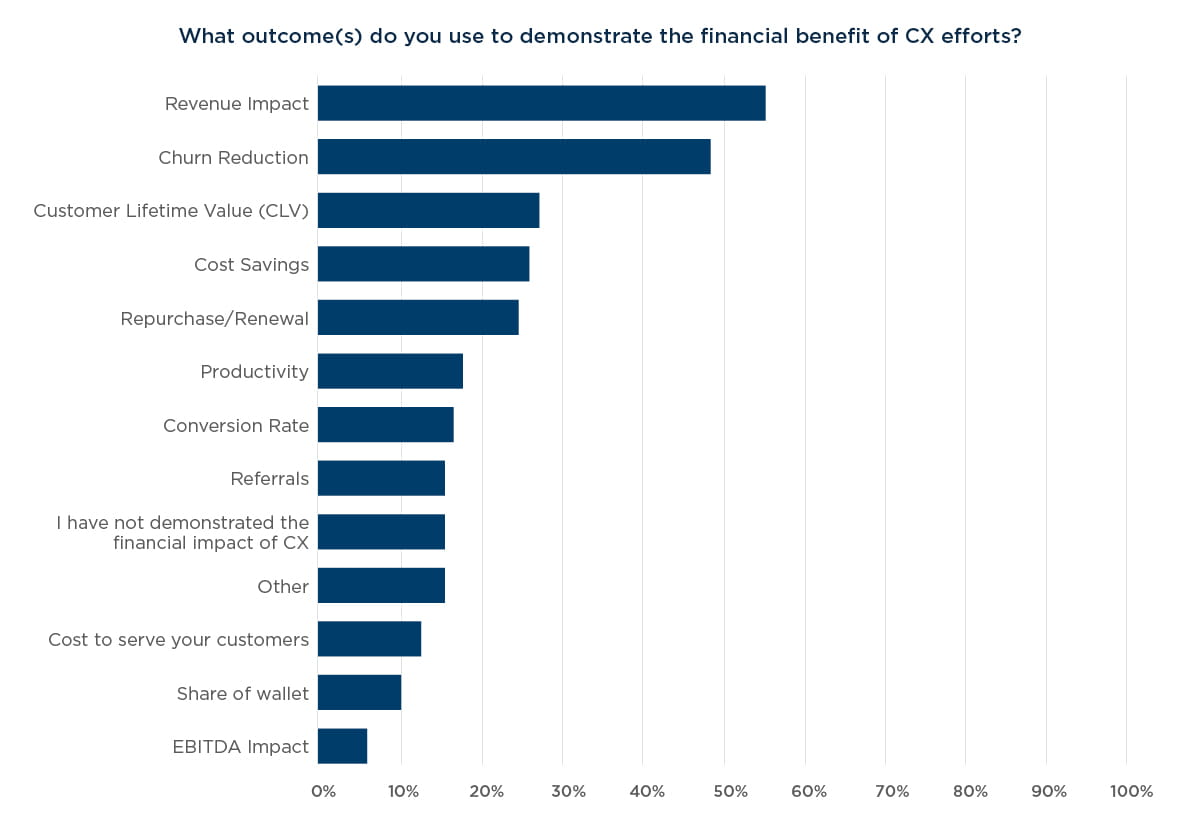

To gain a better understanding for how leaders are attempting to quantify returns on investment (ROI), we partnered with the Customer Experience Professionals Association (CXPA) to conduct a survey of 75 customer experience professionals. Respondents reported that their company’s leaders find it highly important—9 on a scale to 10—to demonstrate the financial impact of customer experience investments. And while customer experience leaders are tracking many metrics, from churn reduction and customer lifetime value to share of wallet, most rate their ability to communicate impact to the C-suite as only a 5 out of 10—10 being highly capable.

To complicate the challenge further, leaders have a short time frame to show progress, and most respondents indicated they lack the necessary tools, workforce, and data to quantify ROI.

Roadblocks to calculating ROI

The focus on ROI in customer experience reflects a broader operational shift that companies have embraced. Management approaches such as lean, Six Sigma, and agile are all about changing the way a company generates and measures value. So, the more that customer experience leaders can quantify the value created over the customer life cycle, the better positioned they will be to home in on critical touch points and implement more effective strategies.

Quantifying the ROI on these efforts is complicated by the sheer breadth of engagement across multiple channels over the customer life cycle. Since organizations must carefully coordinate functions from sales and marketing to customer care and the back office, pinpointing activities that move the needle can be difficult.

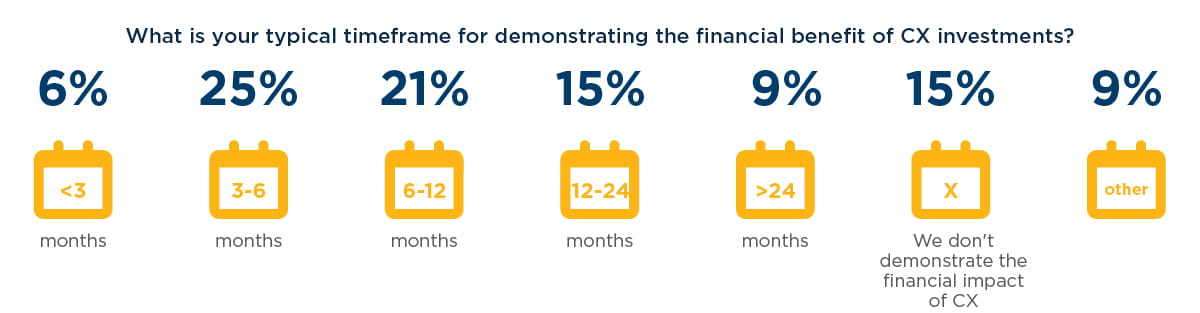

Customer experience leaders feel a sense of urgency to achieve results. Fifty-two percent of survey respondents indicated they have less than a year to connect their investments to top-line financial benefits. Just 24% have the luxury of a one-to two year window. This time frame presents significant challenges since implementing new programs and making improvements necessitate cross-functional collaboration to be successful. Further, the impact of customer experience is not instantaneous; it requires time to be reflected in performance metrics.

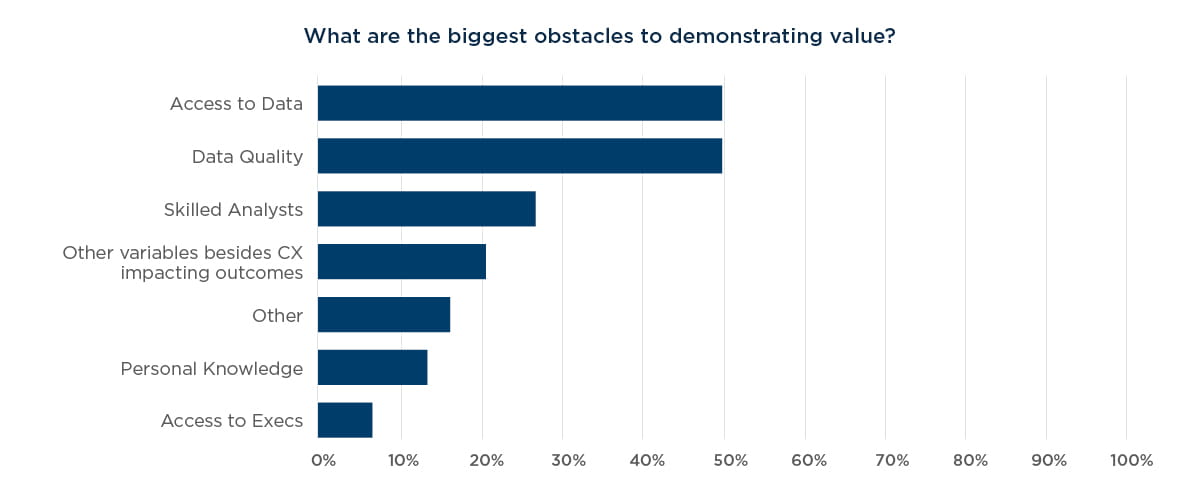

From an operational perspective, consolidating data from purchases, online engagement, and customer service, call for additional investments and support. Forty-nine percent of survey respondents cited the lack of access to data as well as the quality of data as their top obstacles to demonstrating value. Without real-time visibility into customer behavior and satisfaction, demonstrating the efficacy of enhanced engagement can be next to impossible. One respondent noted, “There is a ton of great customer experience ROI data available to executives that present ROI very broadly. For example, businesses in the top 25% of a select metric have 30% higher revenues than those at the bottom. Many senior leaders want a clear formula, but it doesn’t work that way.”

Other obstacles included a lack of skilled analysts to help extract insights from data (27%) and access to executives (7%).

Without data, skilled analysts, or guidance from senior leadership on how to track and communicate performance, customer experience leaders often develop their own models to build effective business cases. Methods such as A/B testing offer a way to pinpoint successful engagement techniques and make improvements.

Other organizations have devised their own metrics, such as a composite score intended to measure the ease of doing business, which can then be linked to a financial outcome. The potential flaw in such approaches is that while these results have relevance to customer experience functions, which are well versed in the specific points along the customer journey, they can seem opaque or incomplete to senior leadership.

So, how can customer experience leaders clearly link investments to business outcomes?

5 strategies to communicate the impact of CX

Executives should take a multi-pronged approach to craft a business case that connects with the C-suite. Five strategies can provide a solid foundation.

1. Get to know the stakeholders and their goals

To better understand what senior leadership cares about, customer experience leaders should apply on internal stakeholders their No. 1 tool: empathy. Walk in the shoes of executives, listen to the words they use, and observe their behaviors to know what makes them tick—and how customer experience efforts can also help them achieve their goals. In addition, customer experience leaders should consider rating stakeholders as “friendlies” (willing to invest financial or social capital in efforts), “foes” (dead set against customer experience), or somewhere in between, and then spend more time with friendlies than foes.

As part of this process, customer experience leaders should be prepared to explain expected financial benefits of redesign efforts relevant to the specific stakeholder. To manage expectations, leaders should segment their efforts by overall maturity of their customer experience programs.

- Early stage. Focus project ROI on find-and-fix outcomes for a specific function or stage of a customer journey (for example, project cost savings within customer support or retention from onboarding redesign).

- Middle stage. More developed efforts, characterized by a broader portfolio of projects seeking to systematically improve high-level customer experience scores, can more easily turn to customer loyalty economics. On the revenue side, these business cases can revolve around growth of customer lifetime value, annual recurring revenue, and reductions in overall cost to serve, all of which translate to higher gross margins.

- Late stage. Mature efforts can use analytics prowess to establish a business case around harder-to-measure intangibles, such as reputation and word-of-mouth advocacy, that enable a company to expand into new markets.

2. Work closely with the CFO and the finance function

The CFO can provide guidance on the metrics the company uses to gauge overall health and progress toward strategic goals as well as the business case model that the function uses to make investment decisions. In addition, the CFO can suggest specific preferred language and framing so that the business case for customer experience investments is structured in a familiar way. Yet our survey found most respondents had not partnered closely with the CFO.

Becoming more familiar with the CFO’s perspective is crucial. With this context, the customer experience leader should seek to connect customer engagement activities with ongoing efforts that can help the company achieve its strategic goals. CX leaders should build a customer-centric Balanced Scorecard that we call CEO$ (e.g. Customer, Employee, Operational, Financial $) to help connect customer and employee experience metrics to operational and financial impact. This helps navigate conversations with CFOs in language that will resonate.

Typically, the CFO is highly influential with the CEO; if the CFO clearly recognizes the connection of customer experience and business value, he or she can be a valuable champion for such measures.

3. Partner with data team to improve data quality and access

Data is a challenge for every company, but that also means it presents an opportunity for customer experience to piggyback onto existing data quality initiatives. Leaders should work with the data management team to help prioritize data sources. In our experience, data analysts are energized by the challenge of converting data into insights, action, and impact. These discussions can give data analysts and engineers a window into how operational, customer-feedback, and behavioral data can help elevate the importance of what they do. There may also be an opportunity to partner with finance to create a task force on data, with the customer at the center.

Aggregating data doesn’t need to be comprehensive to create value. Many companies are making significant investments in CRM systems and master data management but sometimes overlook that every function has its own view of the customer. By breaking down silos and consolidating this data, companies can gain a more accurate view of the customer.

But, improving data quality and access requires a sustained commitment. Companies such as Airbnb and Optum spent upward of 18 months to collect data and build a model that connected customer sentiment and behavior to financial metrics. It won’t be perfect right away. Don’t get discouraged by how big data projects can be; start small and continue iterating until your data is in a place that is providing value and insight to all areas of the business.

4. Make strategic investments in the areas that matter

To ensure that customer experience leaders focus on the areas that can generate the most value, they should follow a structured, four-part process. First, they should create a balanced scorecard, an established business tool that promotes engagement and consensus across functions such as operations, finance, and customer groups. Together, these stakeholders can identify the investments that will benefit their functions. The next step is determining which levers to pull to improve customer experience in these areas. This assessment requires a solid data foundation and the analytics expertise to connect interactions to outcomes over time.

After determining the biggest value drivers across the balanced scorecard, customer experience leaders must manage a portfolio of activities that can improve scorecard metrics and ensure those activities get the necessary resources. Last, customer experience leaders must empower their teams to build the capabilities that create differentiation along these key metrics.

Collectively, this process aligns investments in customer experience with overarching business strategy in a way that contributes to the bottom line.

5. Tell stories that appeal to emotions

While spreadsheets can help to calculate numbers, they often fail to make the case in the same way a story can. Better yet, companies should let their customers tell the story for them. A dental payer, for example, showed video of website users struggling to make it through cumbersome and broken enrollment forms to the executive leadership team. One exasperated prospect commented in the video, “I can’t possibly finish this form because it won’t take my address. This is my address. I don’t know what they expect me to do.” Following the video, the customer experience leader shared the low conversion rates for that enrollment process along with the average lifetime value of customers, making a case for how the fix would improve experiences and generate revenues.

Remember, the C-suite is on a learning journey as well; the more interesting the lessons, the more likely senior executives are to grasp and internalize them. Case studies from other companies, “what if” scenarios (“what if we were able to improve customer lifetime value by 1%?”), and specific insights from actual customers can take executives beyond the metrics.

Leaders should also consider creating an internal communications program to continually reinforce how better customer experience translates to improved financial performance.

By following these five strategies, customer experience leaders can lay the necessary foundation of open dialogue and understanding to highlight their contributions to financial performance. As this link becomes clear, customer experience will come to be a valuable input in strategic planning.