May 2017 | Signature Research

Improving the Dental Patient Experience: 3 Foundational Practices for Providers & Payers

Consumers have greater choice when shopping for dental services. To succeed, dental payers and providers are paying more attention to customer experience.

Today’s consumers have greater choice and freedom of movement when shopping for dental services, and their expectations are higher. To succeed in this consumer- driven marketplace, dental payers and providers are paying more attention to customer experience.

But our recent survey of more than 2,000 dental patients shows that payers and providers are playing catch up to the experiences delivered by retail leaders—experiences that are reshaping consumers’ expectations for all types of businesses with which they interact.

Chapter 1: Today’s dental consumers have greater choice and freedom of movement

Like many industries, the dental industry is undergoing significant change. Healthcare reform has increased consumer access to both dental coverage and care. Industry consolidation has created formidable large competitors with marketing and location advantages. Evolving digital capabilities are transforming all facets of operations, from marketing of dental plans to dental care itself (e.g. teledentistry). And evolving consumer preferences and behaviors are influencing everything from the way consumers shop for dental coverage and services to their expectations for interacting with payers and providers.

At the same time, the percentage of dentists per 100,000 people in the United States is at a 15-year high. At the end of 2015, the American Dental Association estimated that for every 100,000 people in the United States, there were almost 61 dentists. This represents an increase of about 3.5 dentists per 100,000 people since 2001. And while most consumers covered by private dental plans continue to get their coverage through an employer or group, use of individual coverage is on the rise.

To gain an edge in this dynamic and evolving marketplace, leading dental payers and providers are turning to the concept of improving the patient experience. Research suggests this focus is prudent. For example, consumers who have strong emotion ratings (i.e., a component of positive experience) are nearly eight times more likely to try new products and services and 15 times more likely to recommend the product or service. And according to Forrester Research, customer loyalty can drive increased revenue into the billions, but only if customers have options among providers and those providers have differentiated customer experience.

Chapter 2: But when it comes to patient experience, the dental profession has significant ground to gain

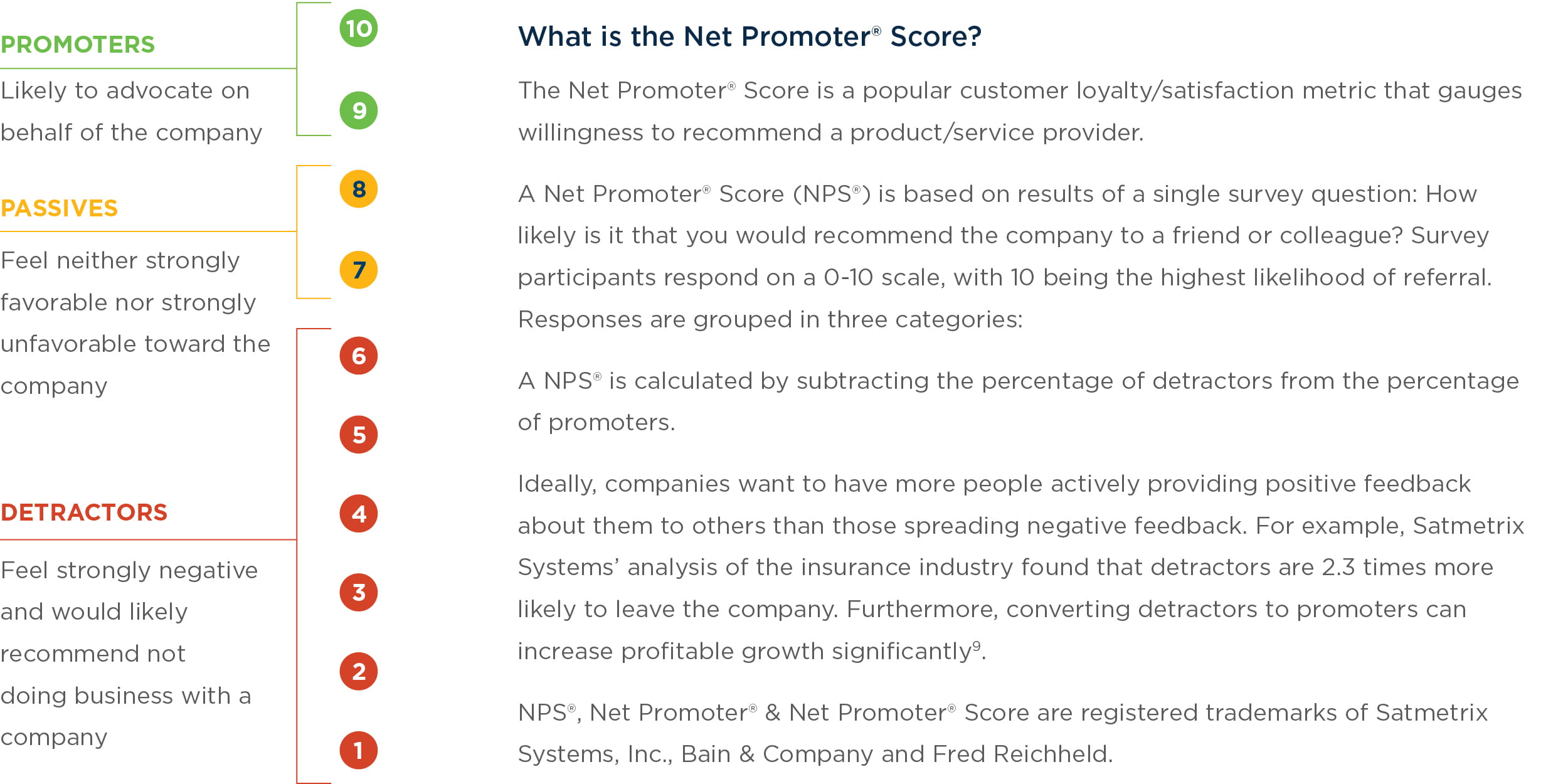

To understand how well dental providers are delivering a patient-focused experience today, West Monroe and a leading dental payer teamed up to survey more than 2,000 consumers about their experience with dental offices and their dentists. Our study used the Net Promoter® Score (NPS®) as a benchmark for customer satisfaction and experience.

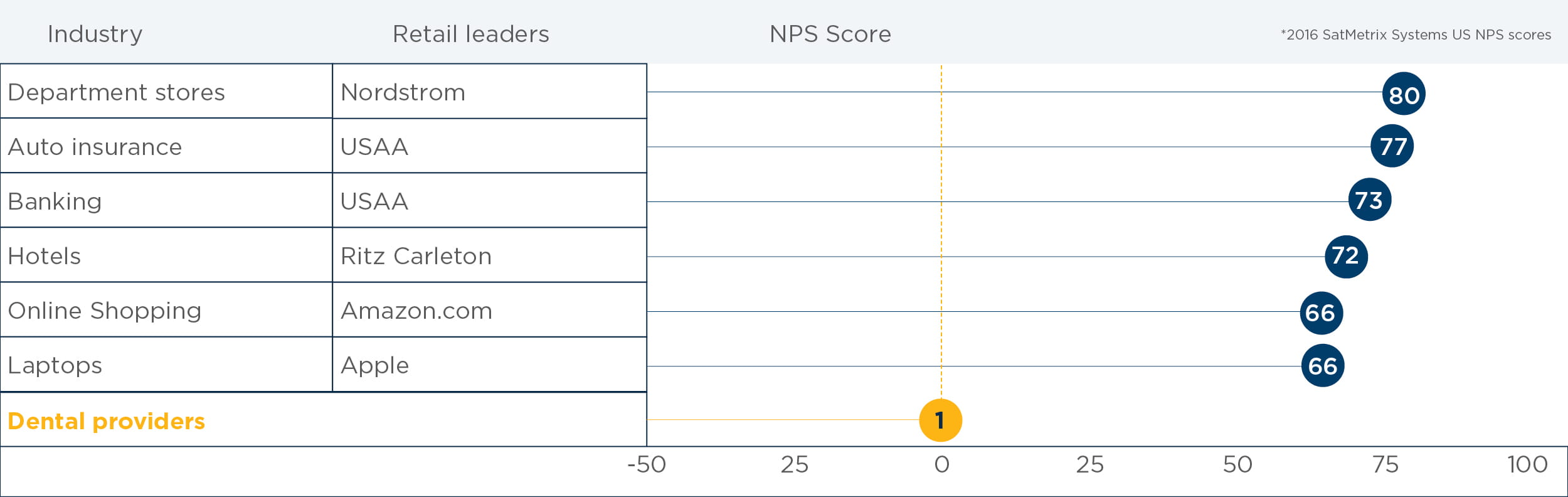

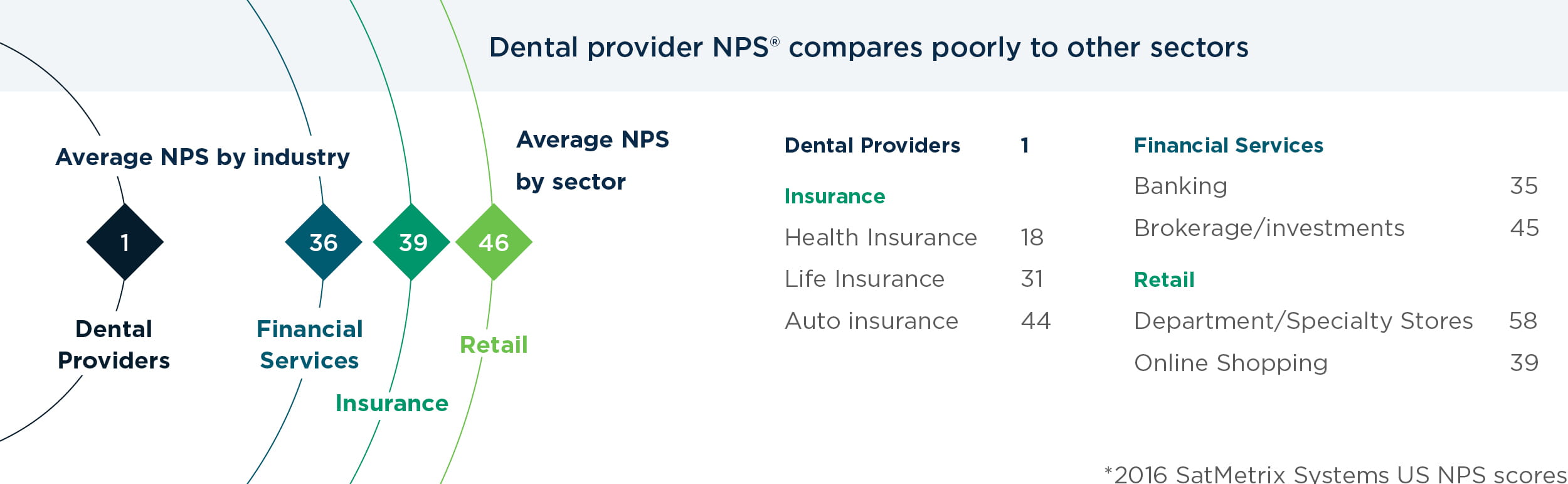

Overall, dental providers rated poorly, with a NPS® of 1. In contrast, average scores for the insurance, financial services, and retail industries are in the 35 to 50 range (Figure 1), while individual retail leaders (Figure 2) have Net Promoter® Scores above 60.

Figure 1

Figure 2

“To put that result in context, the dental provider industry is significantly behind other industries and even further behind organizations known for delivering a great customer experience,” noted Kristin Irving, a director in West Monroe’s Healthcare & Life Sciences practice. “This should be a concern for the industry, but it also signals great opportunities for making improvements that can create market advantage.”

While the survey specifically asked about experience with dental providers, the results and implications should be eye-openers for payers, too. In most cases, a patient is likely to interact with both sides of the industry when searching for, coordinating, and receiving care—creating one ultimate care experience.

Dentist quality has the greatest impact on patient experience. In addition to asking consumers about their likelihood of referring their dental provider (the basis for calculating a NPS®), the survey also asked participants to rate the quality of care provided by the dentist and hygienist/ assistant, as well as the dentist’s “bedside manner.” Additionally, participants were asked to rate characteristics of the dental office, including ease of interaction, feeling of being cared for, dependability in resolving issues, and convenience of scheduling (hours and location). Analysis revealed some correlations with NPS®. For example, key drivers of NPS® among the attributes studied were quality of dentist and, to a lesser extent, ease of dealing with the dental office.

Chapter 3: How can dental payers and providers improve patient experience?

Higher NPS translates to marketing, retention cost, and other advantages

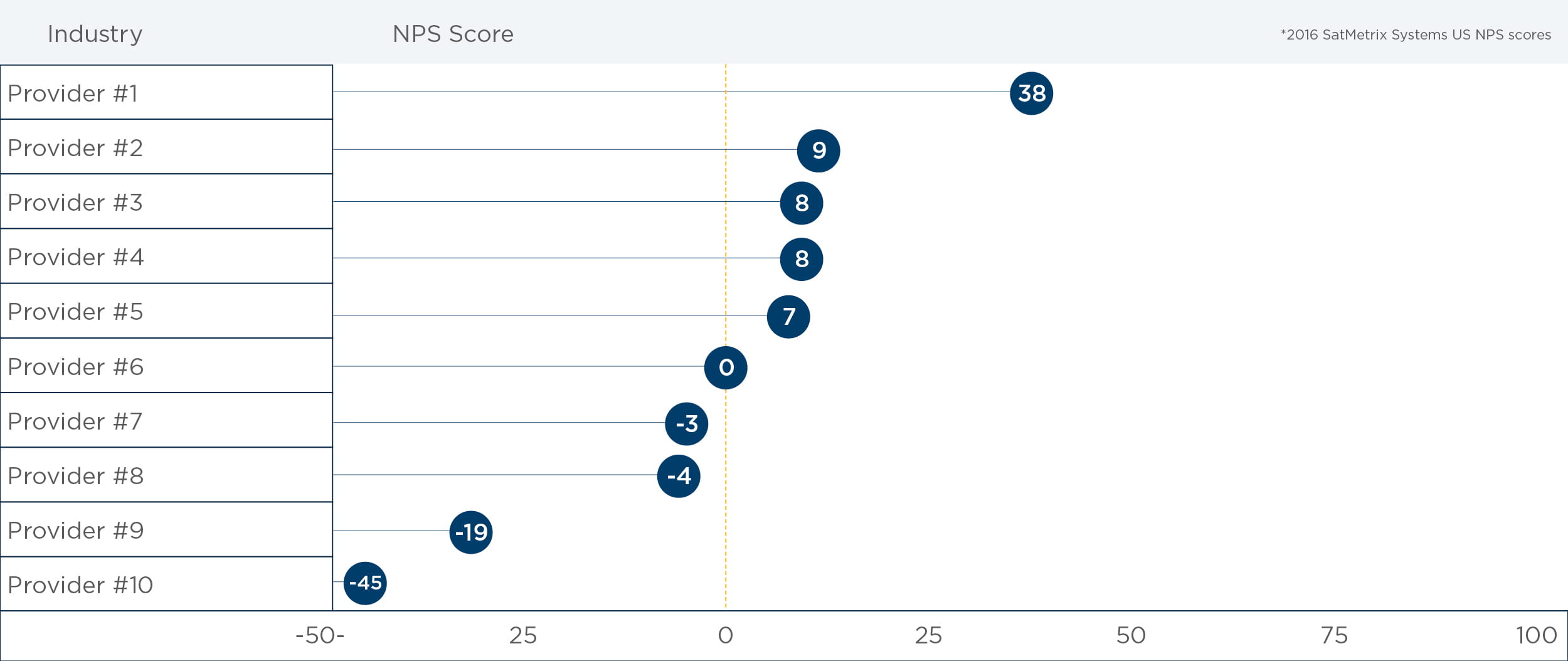

Remarkably, our study of dental support organizations’ Net Promoter® scores found a nearly 80-point gap between the top- and bottom-scoring providers (Figure 3). Gaps of this magnitude are largely unseen in other industries. Our research suggests that the top-rated providers have high- quality dentists, make patients feel cared for, and make it easier for patients to interact with the dental office—for scheduling appointments, filing claims, and obtaining needed information). Although the study covered providers only, payers can draw insight from the importance that dental patients place on quality of care and ease of interaction.

The potential impact of such a large gap is enormous—particularly in an increasingly retail market where consumers have more choice and freedom of movement. Higher NPS® scores reflect in retention rates, word-of-mouth sales, pricing, and cost efficiencies. Forrester Research suggests that customer experience leaders see 5.1 times the revenue growth and 2.7 times the operating margins over laggards. Furthermore, customers demonstrate 4.5 times the willingness to pay price premiums to companies that deliver excellent versus poor experiences.

Figure 3

Conclusion: The dental industry should start improving the dental patient experience by building three essential foundations

1. Start listening to consumers.

Building better experiences starts with asking customers how they feel about doing business with the company. For payers and providers alike, this can be as simple as asking patients a few questions following a visit. For example, how likely are you to recommend your dentist or your dental plan to a friend or associate? Their answers will provide the foundation for a “voice of the customer” understanding that creates a baseline about what consumers think—in turn, allowing payers and providers to evolve and improve their services.

In our survey, participants indicated that dentist quality matters far more to them than network size. This type of insight can be useful to payers as well as providers. For example, a payer could publish dentist ratings in a manner similar to Amazon.com or Yelp ratings. And similar to the way companies like Audi and Mercedes use such data to monitor and work with independent dealerships to ensure quality remains true to their brands, a payer could use such customer feedback to work with providers to improve patient-focused service.

In the healthcare space, e-brokers like GetInsured allow customers to sort potential plans by answering demographic and usage questions.

Customers score each plan based on how well it fits their needs, and scores are further honed as a customer answers more questions. These scores offer providers and payers greater insight about how well they meet customers’ needs and expectations—insight that they can use to refine their service and offerings.

2. Reframe strategic goals.

Instead of setting internally focused objectives like market growth or network size, successful companies frame their strategy and value propositions on the outcomes customers seek. When Disney sought to rethink its stores, the company framed its strategy first and foremost by vividly describing the experience it wanted to deliver: “The best 30 minutes of a child’s day.” That directed decisions about store layout (e.g. space for a stage), digital capabilities (e.g. ability for clerks to conjure Peter Pan with a mobile device), and employee culture (e.g. new applicants read a couple pages from a Disney book to demonstrate how they’d make the stories come alive for children).

Applied to the dental profession, this might include framing a strategy not based on adding new locations but rather delivering service where patients prefer it: mobile units that take dentists to schools and workplaces, or clinics in retail drugstores. For a payer, it might include partnerships that allow for packaging dental products with other forms of insurance to provide customers with one point of access, or incentive strategies that reward customers for getting regular checkups.

“Evolving dental and healthcare technology is also reshaping strategy,” Irving said. “For example, teledentistry advances the concept of taking dental care to the customer one step further. It enables dentists to interact with patients at home using technology available through mobile devices— and we know a growing portion of the population prefers to interact with service providers’ mobile devices.”

Mobile devices can play a key role in reframing strategy for both payers and providers. A recent West Monroe healthcare study found that 91 percent of healthcare consumers whose provider offers a mobile app said they use that app for some or all communication, and 31 percent said they have communicated in real time with a healthcare provider about a specific condition via a mobile app in the past two years. Leading dental payers are also using mobile apps to reach and engage their members with personalized communications, such as checkup reminders.

3. Engage the ecosystem.

Consumer experiences stem from a broader set of interactions than just those within a dental office: It’s an ecosystem that includes payers, dental care products and brands, and others. Payers and providers need to engage the broader ecosystem of players around the experience, much as Airbnb does to help its independent hosts by using data for guidance and training. Both providers and payers should consider how to use data from the manufacturers of emerging electronic toothbrushes, as well as new services from intermediaries like ZocDoc and Brighter to highlight great dentists, to make scheduling easier, to make pricing more transparent, and to reward daily habits that lead to greater oral health.

Looking ahead

Dental providers and payers can (and should) benefit from lessons and best practices of the retail industry, which is setting the standard for delivering a differentiated customer experience. Those that do invest in improving the patient experience stand to realize a healthy return on their investment.